Fintechzoom Netflix Stock Current Market Position

Netflix is a platform we all know is famous for transforming entertainment with its streaming platform. The company’s stock is usually an indicator of membership growth and international expansion initiatives.

Fintechzoom’s platform allows investors to watch NFLX stock closely and receive valuable information related to market trends. The platform focuses on Netflix’s unique market position and competition in streaming. In this guide, we will share the best Fintehczoom insights for NFLX stock.

A Brief History of Netflix Inc

In 1997, Reed Hastings and Marc Randolph launched Netflix Inc. in Scotts Valley, California. At first, the company offered DVD rentals through the mail. In 1999, the company changed the rental market by introducing a subscription model that allowed users to borrow DVDs with no due dates. This invention quickly became popular, allowing Netflix to differentiate itself from typical movie rental companies.

Netflix debuted online streaming in 2007, allowing customers to watch movies and TV shows directly over the Internet. This marked the start of a meaningful transition, with streaming gaining popularity and DVD rentals declining. By 2013, Netflix had begun content development, presenting its first original series, House of Cards.

This deal solidified Netflix’s position as a major content creation and streaming player. The platform now gives millions of subscribers worldwide access to a huge library of original and licensed content.

Introduction to Netflix Stock on Fintechzoom

Netflix stock is a hot topic on Fintechzoom, highlighting the company’s position as a global streaming leader and original content provider. Since its beginning as a DVD rental service, Netflix has become dominant in the entertainment industry. Netflix’s stock is considered a predictor of larger streaming trends and consumer behavior.

Fintechzoom allows investors and analysts to follow Netflix’s stock performance and market fluctuations. This helps people understand how different events affect the company’s worth.

It highlights important patterns influencing the company’s performance in a highly competitive industry. This makes Fintechzoom an important resource for understanding Netflix’s growth and investment opportunities.

Netflix’s Market Position and Competitive Challenges

Netflix is a key player in the streaming sector, leading the market with millions of customers worldwide. Since transitioning from DVD rentals to streaming in 2007, Netflix has set the bar for on-demand entertainment. Its library of TV series and documentaries solidifies its position in the content creation industry.

However, Netflix faces severe competition from several big companies like Disney+, Amazon Prime Video, and HBO Max. Each platform has its own content and price policies, resulting in an increasingly crowded streaming landscape. For example, Disney+ leverages its big portfolio of special franchises, whereas Amazon Prime Video mixes streaming and e-commerce.

The rise of new companies and media businesses adjusting to the digital landscape increases competition. This makes Netflix innovate and preserve its market share by working more. Despite these hurdles, Netflix’s brand recognition and commitment to original shows position it well in the competitive landscape.

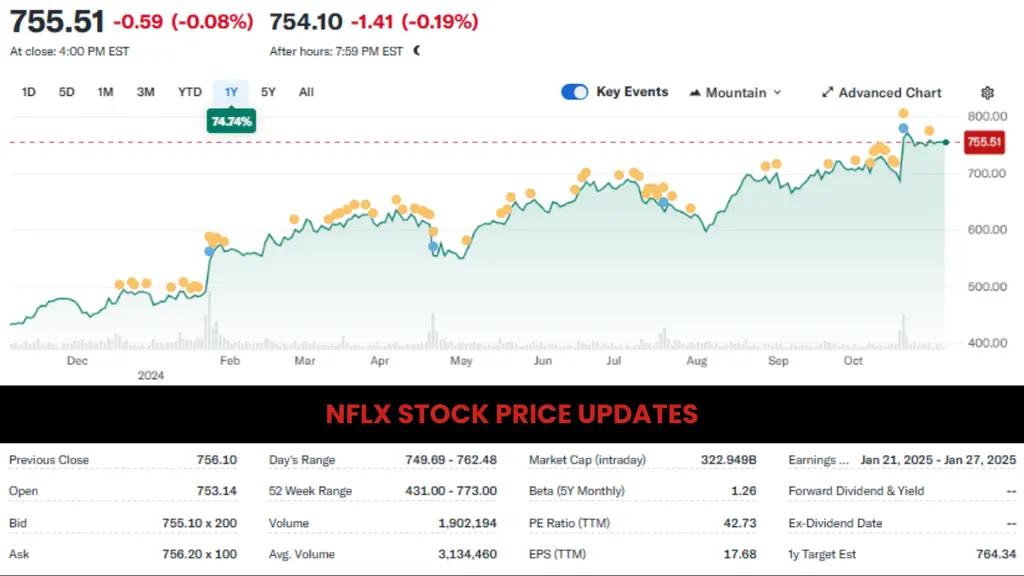

Fintechzoom Netflix Stock Current Performance

The current performance of Fintechzoom Netflix stock shows an upward trend. Netflix’s stock had climbed dramatically by mid-2024, trading at roughly $646.75 per share. This shows investor confidence in the company’s revenue and subscriber growth. Recent quarterly reports showed an outstanding 20% revenue rise year on year, with profits totaling $1.5 billion.

The stock was $755.51 as of November 2024. This growth shows Netflix’s effective content strategy and global expansion initiatives in emerging regions, where member numbers are increasing.

Fintechzoom’s technical analysis also shows a bullish trend with Netflix stock remaining above major moving averages. Analysts are positive about recent upgrades showing expectations of more value increases from Netflix’s unique programs and growing streaming market share.

Factors to Watch Out For Investing in NFLX stock

Are you holding NFLX shares or planning to buy some? Well, any good investor must know these factors to understand what affects Netflix’s stock performance:

Subscriber Growth

Did you know that Netflix currently has around 283 million paid members across 190 countries? Its stock performance is linked to its subscriber base, as user growth suggests increased revenue possibilities.

Netflix’s stock rises when it reports significant subscriber growth, particularly in overseas areas. Similarly, slow or declining subscriber numbers can raise investor worry, reducing the company’s stock value.

Content Production and Quality

Netflix’s stock price is strongly influenced by the performance of its original content, which attracts and keeps subscribers. Popular shows and movies such as Stranger Things and The Crown strengthen the platform’s popularity, which results in more subscriptions. However, high production costs influence profitability, which can cause investors to worry and harm stock performance.

Competition in the Streaming Market

As Netflix competes with major streaming platforms such as Disney+ and Amazon Prime, the increased rivalry can influence its market share and subscription growth. Exclusive material on competing platforms can attract viewers, forcing Netflix to innovate and invest in original content. If Netflix fails to maintain a competitive advantage, it risks losing subscribers, which can damage its stock.

Pricing Strategy

Netflix’s price actions, such as rising subscription fees, have a direct impact on income but can also affect user preservation. Higher pricing can boost income per user but also prevent some customers from entering highly competitive marketplaces. Balancing revenue growth and subscriber happiness is important, as an unfavorable pricing plan will cause stock volatility.

International Expansion

Netflix’s biggest revenue region is the US and Canada, and in 2023 it recorded a total revenue of USD 33.7 billion. But Netflix still has a huge opportunity for growth in other regions where internet penetration is still growing.

Success in growing areas brings in new revenue sources which boosts stock value. However, regional issues such as internet connectivity and local ruling are also a hurdle in Netflix’s ability to expand.

Economic Conditions

Bigger economic situations such as inflation or recessions influence customers’ spending on services like Netflix. During severe economic circumstances, some viewers can cancel or downgrade their memberships, reducing Netflix’s revenue and stock value. Similarly, positive economic conditions result in stable or rising subscription numbers, boosting the stock.

Regulatory and Legal Challenges

Netflix operates in several countries, each with its own set of content standards and censorship laws. Compliance with these laws can raise operational expenses and limit content availability in specific countries, affecting subscriber growth. Regulatory restrictions or fines can also cause investor worry, negatively impacting the stock.

Technological Advancements

Streaming technological advancements, such as higher video quality or AI-driven content recommendations, improve the user experience and attract a bigger audience to the platform. Netflix’s investments in technology give it a competitive advantage in customization, making its service more desirable.

3 Major Risks of Investing in Netflix Stock

Here are some of the biggest risks that can affect Netflix stock and drive investors away:

High Content Costs

Netflix’s strategy of creating original content requires a lot of investment, with billions spent annually on movies and documentaries. While original material draws members, it also puts pressure on Netflix’s revenue, particularly if the content fails to achieve viewership expectations. As competition heats up, continuing this level of spending can strain the company’s resources, negatively affecting its stock value.

Intense Competition in Streaming

Netflix competes in an increasingly competitive market against giants like Disney+ and HBO Max, backed by huge entertainment businesses. Each competitor offers exclusive content and continually bundles streaming with other services.

These competitors threaten Netflix’s market dominance. If Netflix fails to keep up with competitors, it will lose members, resulting in worse revenue and stock performance.

Dependence on Subscriber Growth

Netflix’s income model is primarily reliant on consistent subscriber growth, which has stalled in some markets where it has reached near saturation. Netflix is struggling to gain new customers in the United States; therefore, other markets are critical for future growth.

If subscriber growth does not reach estimates, it may decrease investor confidence and stock volatility. These risks show the importance of investors constantly monitoring Netflix’s financial plans and resilience to economic and regulatory issues.

Conclusion

Fintechzoom Netflix stocks are a strong and popular pick among investors today. The company’s capacity to adapt and expand in a competitive streaming industry shows its long-term success.

Even though the company faces dangers such as high content costs and economic sensitivity, Netflix’s strong brand allows it to maintain a large market share. Monitoring Netflix’s stock performance and market developments is important for investors in making sound investment decisions.

FAQs

Investing in Netflix stock can be a good decision because of the company’s strong financial performance and large investments in original content.

Netflix became so famous due to its features, user-friendliness, and huge catalog, which led to the company winning an Editors’ Choice Award for 2023.

The Fintechzoom Netflix stock price prediction looks good. Netflix aims for an average of $786.34, with highs of $925.00 and lows of $550.00.