Fintechzoom AMC Stock | See What Drives Price Changes

AMC Entertainment Holdings, Inc. (AMC) has been a well-known media and entertainment company since participating in the “meme stock” movement. AMC is known for its theater chains, so investors pay close attention to this stock because of the instability and potential for growth fueled by customer trends and financial strategy.

Now, you can also look deeper into the recent developments with AMC stock and Fintechzoom AMC stock prediction.

What’s the Hype About AMC Entertainment Holdings?

AMC is the biggest movie theatre chain worldwide, operating in North America and other continents. Since its start in 1920, AMC has become one of the biggest chains providing cinema to millions of film lovers worldwide.

The company has been confronted with many challenges, mainly the growth of digital streaming services and the effect of the COVID-19 pandemic. Still, AMC managed a spectacular recovery with the support of retail investors and involvement in the meme stock phenomenon.

That’s why AMC has become a topic of discussion in the stock market, both in terms of optimism and criticism.

Fintechzoom’s Connection With AMC Stock

Fintechzoom has played an important role in informing retail investors about AMC Entertainment’s shares. The platform provides analysis and news, and it has become an invaluable resource for anyone following AMC’s unpredictable journey.

Fintechzoom discusses details such as the market responses and AMC’s financial updates to help investors make smarter decisions. The website also emphasizes expert perspectives and important data points to help you understand market fluctuations and trading techniques. Fintechzoom AMC stock forecast and informative articles keep retail investors up to date on the performance of AMC stock.

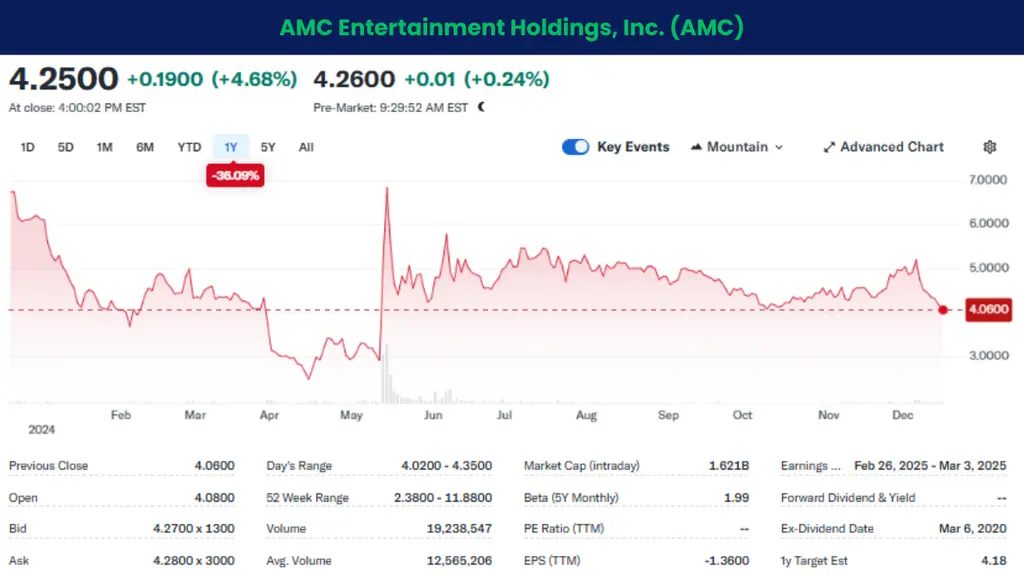

Fintechzoom AMC Stock Split

On August 24, 2023 AMC Entertainment completed a 1-for-10 reverse stock split, combining ten shares into one. This measure was intended to raise the stock price and make it more appealing to institutional investors.

AMC changed its preferred equity units (APEs) into common shares. This conversion simplified the company’s share structure by removing the APE units and combining all equity into ordinary shares.

5 Key Factors About AMC Stock Price

Knowing what drives AMC stock is important for investors and anyone interested in the company’s future. Here are the primary drivers that affect AMC’s stock price:

Box Office Performance and Movie Releases

AMC Entertainment’s revenues are highly dependent on the movies performed in the theaters under its wing. The blockbusters that are high-grossing and the demand of customers can help the company to increase its earnings. In this way, the price of its stock will rise.

Customer Behavior and Theater Attendance

The ongoing recovery of movie theaters from the impact of the COVID-19 pandemic plays an important role in AMC’s stock performance. With increased patronization, AMC gains through increased box office and concession sales. However, with more customers embracing the online streaming culture, the same customer might not want to visit a cinema but instead watch movies at home.

AMC’s Financial Health and Debt Management

The financial health is one of the factors that can strengthen or weaken the AMC stock price. The firm has been experiencing financial downfall recently, especially during the pandemic when cinemas were closed. To stay alive, AMC borrowed huge amounts of debt, which has raised concerns about long-term liabilities management.

Economic Factors and Market Conditions

Like all stocks, AMC is subject to bigger economic variables. For example, an economic recession or inflation would cause customers to spend less on leisure activities like attending movies. This declines box office revenues. Other determinants that could affect AMC’s price are changes in interest rates and the overall market sentiments.

Competition of Streaming Services

This is the biggest threat AMC faces with its business model. With the rise in streaming services and other entertainment, people stay home to enjoy a movie night. This cuts down on the demand for traditional movie theaters. The threat to AMC’s revenue growth and, later its stock could be affected by this shift in entertainment.

The Major Players Behind AMC’s Rise

Several major players have fueled AMC Entertainment’s stock price and market position growth over the last few years. The list includes individuals who have shaped the trajectory of AMC, such as:

Retail Investors

One of the most important factors for AMC’s ascendancy is the growing force of retail investors, mainly from online forums such as Reddit’s WallStreetBets. During the first quarter of 2021, AMC became one of the central stocks of the “meme stock” movement. At this moment, retail investors got together to push the stock price upward, which forced institutional investors who had shorted the stock.

AMC CEO Adam Aron

The AMC CEO, Adam Aron has been important for the company’s rise to fame especially in the post-pandemic period. During his time, AMC made some strategic decisions that have drawn new investors, such as embracing the meme stock phenomenon. He has portrayed himself as the champion of AMC’s shareholders, who communicated with the public through Twitter and even hosted live streams to increase investor confidence.

Hedge Funds and Institutional Investors

Retail investors have been the driving force behind AMC’s rise, but institutional investors and hedge funds have also played an important role. Many large hedge funds had short positions in AMC stock, betting the price would fall.

However, when mass retail started buying the shares altogether, it created a “short squeeze” that compelled these hedge funds to cover positions, fueled by the stock’s upward rise even more.

Social Media Platforms and Forums

Social media platforms have played an important role in AMC’s rise by providing a space for retail investors to communicate and share information. Reddit’s WallStreetBets forum became a hub for people discussing AMC and encouraging each other to invest. Twitter and YouTube influencers further accelerated the AMC stock price boost through stock hype.

Movie Studios and Content Creators

The movie industry content creators have been a determining factor in the rise of AMC. The big blockbuster movies have been the most important driver in attendance at theaters.

Successful films from big production houses that reap the boxes come as a direct benefit for AMC. Big franchises like Marvel or Fast & Furious that tend to get more famous benefit AMC greatly because major studios seem strategically scheduled.

Risks That Come With Investing in AMC Stock

Investing in AMC stock comes with some risks, such as:

Financial Vulnerability

AMC still has a large debt and is vulnerable to financial risks. Although the meme stock trend provided short-term relief, long-term financial health depends on AMC’s ability to provide consistent revenue.

If the number of people who used to go to the cinema doesn’t return to pre-pandemic numbers, AMC can be in a position where it cannot repay its debts. This will impact its stock price.

Declining Theater Crowd

Customer trends are changing because of streaming services, with more viewers watching movies at home. Although AMC continues to enhance in-theater experiences, many customers prefer to use the streaming services offered by Netflix. This preference change can threaten AMC’s ability to fill theaters and keep up revenue growth.

Dependence on Blockbuster Films

The success of AMC depends highly on the blockbuster performances of major films. It would affect earnings if there is a poor box office season or a lack of blockbuster movies. AMC will face challenges in raising revenue without fewer high-profile movie releases or audience interest.

High Volatility and Speculation

AMC’s stock is volatile, and its movement seems to be based more on speculative trading than fundamentals. This company’s dependence on meme stock investors has created very uncertain swings in stock prices. Such volatility makes risks rise for long-term investors which means the stock price will not reflect how business is going with the firm.

Market Competition

Day by day, AMC is getting more competition from other digital streaming services, including Amazon Prime and Disney. This puts pressure on the AMC company in theaters as people spend less time in the theaters for in-home streaming.

Moreover, this is an evolution accelerated by the pandemic, which now poses a serious problem for the business model. Such market competition would damage the price of AMC stock.

Ready to Invest in AMC Stock?

It’s true that retail investors and the meme stock trend have fueled massive fluctuations in Fintechzoom AMC stock price. Even though the company profited from this boom, it continues to confront issues like high debt and competition from streaming services.

AMC’s stock future depends on its ability to react to these problems while maintaining good box office performance. Investors should be cautious since the stock is volatile and impacted by circumstances outside AMC’s control.

FAQs

Vanguard has the most shares in AMC Entertainment (AMC).

Investing in AMC stocks will expose you to financial markets with benefits from increased AUM and market performance.

Retail investors have a big impact on AMC’s stock price through coordinated purchasing and holding activity.