Fintechzoom SQ Stock: Latest Updated of 2025

Square Inc. is a well-known digital payments startup that offers customers simple cashless transaction options. What started as a simple payment solution has grown to include services such as digital wallets and cryptocurrency trading.

If you are an investor who is thinking of putting money in SQ stock, Fintechzoom can help you. FintechZoom’s articles on SQ stock give concise, easy-to-understand information on market trends and what’s next for Square, Inc. So, how can you benefit from Fintechzoom SQ stock analysis?

What Is Square (Block, Inc.)?

Square, Inc., now known as Block, Inc., is a major leader in the financial technology industry known for transforming digital payments and helping small businesses grow. Founded in 2009 by Jack Dorsey and Jim McKelvey, Square started with a simple goal: to make payments easier and more accessible for small businesses.

This innovation gave opportunities to small business owners and entrepreneurs who could not afford standard payment systems. Square has expanded beyond its initial offerings and is now operating in many digital banking areas. Block, Inc. specializes in peer-to-peer payments, Bitcoin, and small business financing.

The company’s digital wallet, Cash App, has grown to be one of the most popular peer-to-peer payment platforms in the United States. Millions of users rely on it for everything from money transfers to stock and Bitcoin investments.

7 Financial Products and Services of SQ

Square, Inc. has created many financial tools and services that make payments and digital transactions available to consumers and companies. Here are some of the main goods and services provided by Square:

Square Point of Sale (POS) Systems

Square’s POS systems are designed to allow small businesses to quickly accept many payment methods, such as credit cards and digital wallets. The device is simple to use and compatible with cellphones and tablets, which allows businesses to eliminate traditional cash registers. POS systems also have inventory management and sales analytics tools, which give business owners a lot of information.

Cash App

Cash App is a popular digital wallet that allows users to send and receive money instantaneously, making it ideal for fast peer-to-peer payments. It also allows users to invest in stocks and Bitcoin, making it an easy way to get started trading. Through the Boost program and Cash Card, you can benefit from savings and more convenient transactions.

Square Capital

Square Capital offers small business loans with a flexible repayment plan based on daily sales, which is available to companies of all sizes. Square’s transaction data allows for more flexible eligibility decisions, especially for companies with limited credit history. These loans help small businesses develop by funding inventory and operations.

Squared Invoices

Square Invoices lets businesses quickly and simply create professional invoices, which are appropriate for industries that rely on invoicing. It provides automated reminders and payment tracking, which allows firms to manage past-due payments successfully. Due to the integration with Square POS, payments and invoicing can be kept in one location.

Square Payroll

Square Payroll is a payroll solution designed specifically for small businesses. It makes it easier to pay employees and contractors. It calculates and files payroll taxes automatically, which ensures business owners stay compliant. The integration with Square’s time-tracking tool gives payroll accuracy and the ability to support employee benefits.

Square Online and E-Commerce Solutions

Square Online enables businesses to quickly set up e-commerce sites that combine in-person and online sales under one platform. This integration with Square POS helps businesses manage inventory and customer data across both channels. Square also works with social media and delivery services to give businesses extra opportunities to reach customers.

Cryptocurrency and Blockchain Ventures

Fintechzoom SQ stock buy or sell, and Bitcoin storage show Square’s interest in cryptocurrencies. Block has also invested in Bitcoin mining with the goal of decentralizing access to crypto technology.

These activities are compatible with the company’s larger ambition for a blockchain-based financial future, as shown by its Block Inc. rebranding.

Fintechzoom SQ Stock Live Index Price

The Growth of SQ Stock

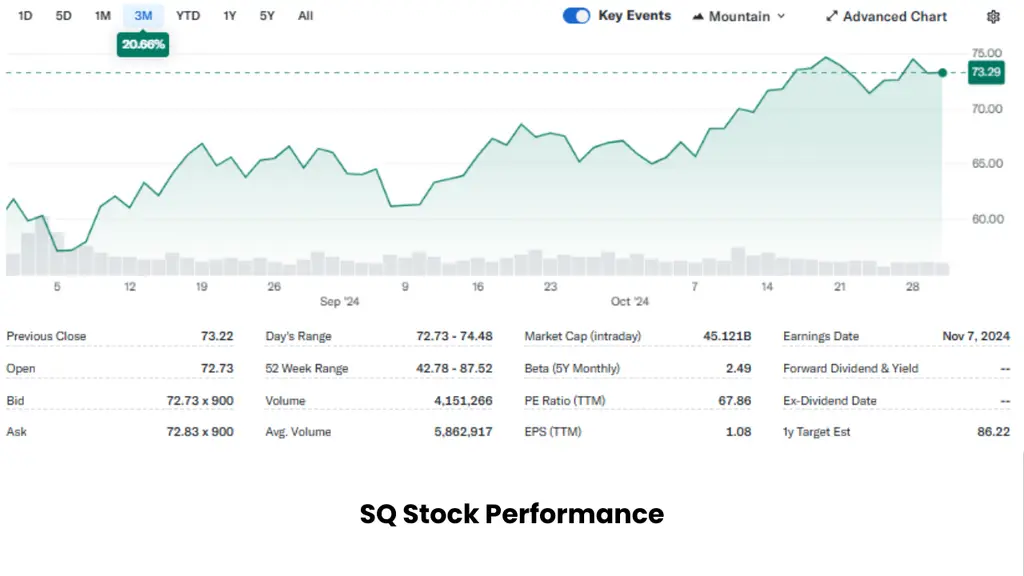

SQ stock has grown recently due to extended product lines and outstanding performance in the digital banking and cryptocurrency industries. Cash App has made a notable contribution by improving user engagement and earnings, which will likely maintain this upward trend.

As of March 14, 2025, Block Inc. (NYSE: SQ) is trading at approximately $83.89 per share. This reflects a 16.6% increase from its October 2024 price of $71.90.

Analysts remain optimistic about Block’s future performance. The average price target is $103.40, with forecasts ranging from a low of $65.00 to a high of $120.00, suggesting a potential 18.20% increase from current levels. Additionally, long-term projections estimate that Block’s stock could reach $109.88 by February 2030, indicating a potential 30.98% return over a five-year investment period.

These projections are underpinned by Block’s robust revenue streams and unique expansion strategies, which continue to drive investor confidence.

Blockchain Technology and Its Impact on SQ Stock

Blockchain technology has influenced the growth of Sqyare Inc. (SQ) shares, particularly through its integration with Cash App and expansion into cryptocurrencies. Square’s support for Bitcoin transactions has attracted a huge user base and many revenue sources.

Furthermore, Square’s focus on decentralized finance is consistent with blockchain’s potential. This positions it to gain from emerging crypto markets and the growing DeFi ecosystem. These measures strengthen investor confidence in SQ’s long-term fintech and digital currency development potential.

Short-Term and Long-Term Investment Opportunities

When comparing short-term and long-term investment prospects in Square, Inc. (SQ), you can analyze benefits depending on several time frames:

Short-Term Investment Opportunities

Here are the short-term investment opportunities of SQ stock:

- Price Volatility and Market Changes: SQ stock is popular among traders due to its price volatility, known for its engagement in cryptocurrency and digital payments. Both of these things react quickly to market changes.

- Quarterly Earnings and Announcements: Short-term opportunities come around earnings releases or partnerships, which can result in temporary stock price increases.

- Industry Momentum in Fintech: Increased adoption of digital payment platforms and cryptocurrencies can benefit SQ, particularly during rapid growth in these sectors.

Long-Term Investment Opportunities

Long-term investment opportunities in SQ stock are described below:

- Expanding Cash App and Ecosystem: Squares’s Cash App is quickly expanding, including income streams from peer-to-peer payments and Bitcoin, which can fuel consistent growth.

- Innovations in Blockchain and DeFi: Square’s emphasis on blockchain technology, particularly with Bitcoin and other decentralized finance (DeFi) projects, positions it for long-term gains as these markets grow.

- Global Market Expansion: Square’s recent international expansions, such as Square Card’s UK debut, offer long-term revenue growth possibilities and a bigger user base.

Challenges and Risks Faced by Square Inc

Square Inc. (Block, Inc.) faces many dangers that can affect its growth trajectory. Here are some challenges and risks associated with this company:

Regulatory Inspection

Square faces regulatory issues in the fintech business, such as payment processing and cryptocurrency transactions. The company’s compliance with many foreign laws can drain resources and limit operational flexibility. Increased inspection by government agencies can result in fines or operating restrictions, which can affect overall growth.

Market Competition

The fintech industry is very competitive, with many established and rising companies competing for customer attention. Square can constantly innovate to preserve its market position and attract new users, which can result in higher operational costs. If the company fails to differentiate its offerings, it risks losing market share to more competition.

Volatility in the Cryptocurrency Markets

Square’s involvement in cryptocurrency trading exposes it to the volatility of its assets, which can result in unexpected revenue streams. Cryptocurrency price swings can greatly impact user engagement and overall business effectiveness. This reliance on a market can prevent some investors from considering SQ stock a stable investment option.

Technological Challenges

Square is a technology-driven corporation, and it must constantly upgrade and secure its platforms to protect user data and ensure service dependability. Any technology failures or data breaches can drastically damage customer trust and result in financial losses. Furthermore, keeping up with rapid technological improvements requires many expenditures, which can strain financial resources.

Fintechzoom SQ Stock Price Prediction for Future

Square Inc. stock’s future growth is expected to be good due to its focus on fintech innovation, cryptocurrency, and the digital financial ecosystem. Fintechzoom SQ stock prediction is that it will have constant growth as it expands financial services such as peer-to-peer payments and Bitcoin trading.

The company ambitions to continue worldwide expansion and advance decentralized finance (DeFi) projects. Squares’ different revenue streams keep the SQ stock a strong long-term performer in the digital economy.

Conclusion

Fintechzoom SQ stock page insights offer investors both opportunities and problems. The company’s creative approach to digital payments and cryptocurrencies, as do platforms such as Cash App and continuous expansion initiatives, makes it well-suited for future growth.

SQ stock will still be a fascinating investment choice within the fintech industry, appealing to those prepared to handle its complexities and possible benefits. However, don’t forget to analyze the risks and challenges regarding the company’s performance.

FAQs

Your financial goals and market conditions determine your investment potential and whether the stock is good for you or not. But still, the stock’s future is looking bright.

The number of shares of SQ as of October 2024 is 617,666,000.

Analysts of Squre’s stock have an average target of 89.13, with a low of 55 and a high of 106.