Fintechzoom GME Stock – Gold Mine for Investors and Gaming Enthusiasts

Investors seeking diverse asset classes to maximize their profits should consider GameStop Corp. (GME), especially if they have an interest in gaming. GameStop, a leading retail company, specializes in video games, gaming merchandise, and consumer electronics, with a significant presence both in-store and online.

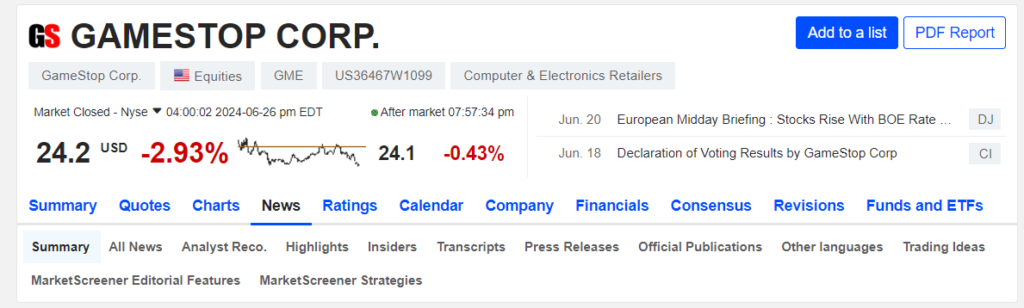

Notably, GameStop has a remarkable history of stock price movements. On Fintechzoom, you can view fintechzoom GME stock prices, history, and trends, making it an essential resource for informed investment decisions.

Uncovering the Origins of Fintechzoom GME Stock Coverage

Fintechzoom’s coverage of GameStop (GME) stock originated from the dramatic events of early 2021. GameStop, traditionally focused on retail sales of video games and electronics, saw its stock price surge due to a short squeeze driven by retail investors on social media platforms like Reddit.

This unprecedented event put GameStop in the spotlight, showcasing the potential and volatility of retail-driven stock movements.

Recognizing the importance of these developments, Fintechzoom began offering in-depth insights and analyses of GME stock. Their aim is to provide investors with real-time data, historical performance, and expert opinions to help navigate the dynamic landscape of GameStop’s stock.

Fintechzoom’s strategic inclusion of GME stock analysis caters to the growing interest and demand for comprehensive financial information on this highly volatile stock.

Explore Fintechzoom GME stock prices, historical data, and expert analyses to stay ahead in the ever-changing financial market.

Fintechzoom GME Stock Live

Fintechzoom is a complete platform in the financial market. It provides financial news, real-time updates about stock prices, day-to-day analysis, expert opinions, market trends, and much more.

The platform provides updates about different stock prices, including GME stocks. The Fintechzoom GME stock page offers a comprehensive overview of the stock performance, real-time price updates, and analytics that help investors make informed decisions. In short, it provides A snapshot of the stock’s current state.

Key Metrics and Analytics

Some of the prime metrics and analytics that are included in the Fintechzoom GME stock page are as below.

- Real-time data on GME’s current stock prices

- GME’s total market value

- Earnings per share

- Dividend yield

- Trading Volume

Check Out: FINTECHZOOM GE STOCK – KEY INSIGHTS AND LATEST STATS

Analysis of GME Stock Charts

Fintechzoom GME stock charts provide a visual of the stock prices over specific periods. You can view price charts of custom dates for one year or one day. These price charts help investors highlight key trends and patterns in the GME market. Here is a list of some of these.

- Support and resistance levels

- Moving averages

- Bollinger bands

- Relative Strength Index (RSI)

- Trading Volume spikes

All these details are helpful for the investors. They can analyze these values and can invest when the stock prices are low and are expected to rise.

Largest Shareholders in Fintechzoom GME Stock

Ryan Cohen, serving as the chairman of GameStop Corporation’s board of directors, stands out as the largest individual shareholder of GME (GameStop) stock.

Known for his transformative impact on Chewy Inc., Cohen has brought a strategic focus on digital transformation to GameStop, aiming to reshape its market position.

Institutional investors such as Vanguard Group, BlackRock, and Fidelity Investments hold substantial stakes in GameStop, underscoring broad institutional interest in the company’s potential and market performance. These institutions play a pivotal role in influencing the stock’s stability and long-term growth trajectory.

Meanwhile, retail investors, organized through online platforms like Reddit’s WallStreetBets, have emerged as a formidable force in GME stock’s trading dynamics.

Their collective actions have significantly influenced the stock’s volatility and trading volumes, highlighting the evolving landscape of investor participation in GameStop’s equity.

Significant Milestones for Fintechzoom GME Stock

The journey of GME stock on Fintechzoom is marked by several significant milestones. One of the most notable events was the unprecedented surge in January 2021 when GME stock prices soared from single digits to nearly $400 per share within a matter of days. This dramatic increase was primarily driven by retail investors’ coordinated efforts to challenge institutional short-sellers.

Another milestone was the subsequent regulatory scrutiny and market adjustments that followed the surge. Regulatory bodies stepped in to investigate potential market manipulation and to implement measures to protect retail investors and ensure market stability. These actions included temporary trading halts and new rules regarding margin requirements.

Fintechzoom also introduced advanced analytical tools and real-time data feeds during this period to provide more robust support for investors. These tools helped users track price movements, trading volumes, and other key metrics more effectively.

Market Performance of Fintechzoom GME Stock

The market performance of GME stock has been characterized by extreme volatility and rapid price fluctuations. After the initial surge in early 2021, GME stock experienced significant ups and downs, influenced by various factors including market sentiment, corporate developments, and broader economic conditions.

Fintechzoom’s real-time updates and comprehensive analysis have been instrumental in helping investors navigate this volatility. The platform offers insights into trading volumes, price trends, and technical indicators such as moving averages and RSI. These tools enable investors to identify potential entry and exit points, understand market sentiment, and make informed trading decisions.

Moreover, Fintechzoom’s emphasis on a balanced approach to trading is crucial. They advocate for the importance of risk management strategies such as stop-loss orders and portfolio diversification to mitigate potential losses.

By providing detailed analyses and practical advice, Fintechzoom supports investors in achieving a more balanced and informed approach to trading GME stock.

GME Financial Analysis

GameStop is a multinational company that provides video games, consumer electronics, and wireless services to retailers. It is an emerging company but has strong financial records.

Here are some statistics highlighting the financial conditions of GME for the year.

- Market Cap: $5.015 billion

- Shares Out: 306.19 million

- 10 Day Average Volume: 14.41 million

- Dividend: N/A

- Dividend Yield: N/A

- Beta: -0.39

- Year-To-Date % Change: -3.48

- Earning Per Share (TTM): 0.02

- P/E (price to earning ratio) (TTM): 747.94

- Fwd P/E (NTM): 1,637.99

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): $26.50 million

- Return On Equity (TTM): 0.50%

- Revenue (TTM): $5.273 billion

- Gross Margin (TTM): 24.54%

- Net Margin (TTM): 0.14%

- Debt To Equity (MRQ): 2.13%

Technical Analysis

Now, we will dive into a technical analysis of Fintechzoom GME stocks i.e. analyzing statistical data and market trends rather than focusing on the company’s financial conditions.

The current Fintechzoom GME stocks show a promising bullish trend. The stocks have been trading in a range-bound manner for the past few weeks, but the recent price changes indicate a potential breakout.

Also Read: FINTECHZOOM GE STOCK – KEY INSIGHTS AND LATEST STATS

1. Moving Average

According to the deep technical analysis of Fintechzoom GME stocks, the 50-day moving average is trending above the 100-day moving average, which indicates a short-term bullish trend.

Moreover, the 200-day moving average is still below the 100-day moving average, but the price gap is narrowing, which means that there will be a potential long-term trend reversal.

2. Relative Strength Index (RSI)

Overall if we see the RSI trend, it is trending upwards, which means an increase in buying pressure. However, the current RSI is 55, which indicates a neutral condition.

3. Bollinger Bands

These days, the stocks are trading above the upper Bollinger bands which indicates a strong bullish trend in the coming days. However, the bands are contracting, which means the market can break out at any moment.

In short, the current Fintechzoom GME stock market is experiencing a bullish trend, but many different factors are indicating that the market can crash at any moment. Traders and investors should keep a close eye on the stock prices and consider all the buying and selling opportunities they encounter.

Pro Tip: Always follow risk management strategies to avoid any big loss.

Sentiment Analysis

Investors are the ones who are driving the stock market, and their sentiments are very crucial to the market. Fintechzoom GME stock market trends are closely monitored by the investors and they openly share their opinions with the world. Reddit’s WallStreetBets (WSB) has become a hub for bullish and bearish discussions.

1. Bullish Opinions on Fintechzoom GME Stock

Here are some of the bullish opinions by the stock market investors.

- Talks about huge expectations about the turnarounds under the new management.

- Belief in the company’s ability to adapt to the changing market trends.

- Optimistic thoughts about GameStop’s potential growth and revival.

- Investors are excited and optimistic about GameStop’s efforts to expand into the growing esports and gaming industries.

2. Bearish Opinions on Fintechzoom GME Stocks

Here are some of the bearish opinions by the stock market investors

- There are some solid concerns about GME’s declining sales and profitability.

- Worries about the impact of socio-economic conditions and COVID-19 on the gaming industry.

- Fear of a prolonged bearish market for GameSpot.

- Investors are unsure about GameStop’s ability to compete with market rivals such as Amazon, Best Buy, and other platforms.

3. Practical Investment Strategies

Risk Management:

- Diversification: Avoid putting all your capital into GME. Spread investments across various assets to reduce risk.

Technical Strategies:

- Use Stop-Loss Orders: Protect against significant losses by setting stop-loss orders.

- Follow the Trend: Utilize trend-following strategies based on moving averages.

Fundamental Strategies:

- Long-Term Investment: If you believe in the long-term potential of GME, consider holding the stock despite short-term volatility.

Practical Tips:

- Stay Informed: Regularly update yourself with the latest news and trends related to GME.

- Avoid Emotional Trading: Make decisions based on analysis rather than emotions.

Final Words

Analyzing Fintechzoom GME stock involves key technical tools like Moving Averages, RSI, and Bollinger Bands to understand price trends and market movements.

Social media platforms like Reddit’s “WallStreetBets” significantly impact GME’s volatility. Effective strategies, including diversification and stop-loss orders, are crucial for managing risks.

Visualization tools enhance the prediction of stock movements. Staying informed, implementing risk management, and maintaining a long-term perspective improve trading outcomes.

Utilize Fintechzoom for comprehensive Fintechzoom GME stock analysis and insights to make informed investment decisions and optimize trading strategies.

Frequently Asked Questions

GameStop’s stock closing price was $483.

It can go as low as $5.60.

Vanguard owns the most GameStop stocks.

Fintechzoom GME stock market forecast a rise of 5% and reach $15.04 per share in June 2024.

Fintechzoom provides a comprehensive analysis of GME stocks, historical prices, market trends, patterns, and the impact of social media on investors’ sentiments.

The sentiment varies, with significant influence from social media and news coverage. It’s essential to keep an eye on both to gauge market sentiment accurately.

Diversification, stop-loss orders, and staying informed are crucial strategies to mitigate risks.