Fintechzoom GM Stock: How Competition Is Impacting Prices

Fintechzoom’s research of General Motors (GM) shows GM’s expanding presence in the electric vehicle (EV) and self-driving markets. GM’s financial performance is strong due to high sales and a dedication to innovation.

The company is actively developing its EV lineup and forming autonomous technology collaborations to reshape its brand in emerging markets. With more global rivalry and economic shifts, Fintechzoom sees a combination of threats and possibilities for GM stock. Let’s go in-depth to tell you all about itFintechzoom GM stock.

Evolution of General Motors

William C. Durant formed General Motors (GM) in 1908 by combining brands such as Buick, Cadillac, and Oldsmobile to create an automotive empire. In the 1920s, GM took an innovative approach and created separate divisions for each brand to appeal to different markets.

This strategy allowed GM to outperform competitors, especially in the post-World War II era, when GM became an American industry leader. Over the years, GM improved its automobile technology by selling cars with safer and more efficient manufacturing procedures. Now, GM is shifting toward electric and self-driving vehicles, becoming a leader in sustainable and technologically driven mobility.

GM Stock Analysis by Fintechzoom

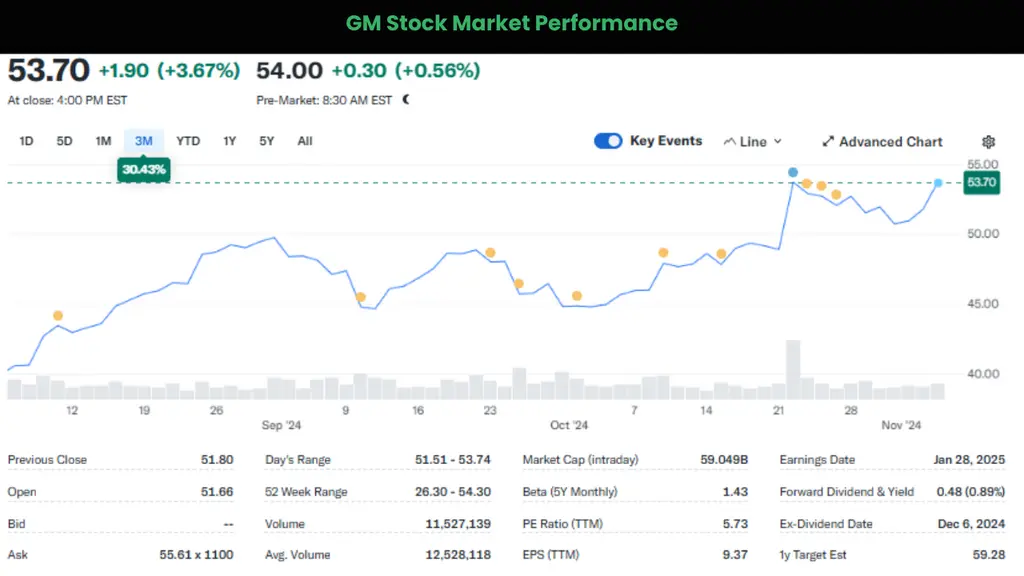

Fintechzoom’s study of General Motors stock gives investors a detailed look into the company’s financial performance and growth strategies. Fintechzoom GM stock symbol on the NYSE is GM. General Motors’ stock is very important to investors interested in traditional car markets and electric vehicles (EV).

Fintechzoom identifies GM’s stock revenue growth, strategic investments in EV technology, and strategy for overcoming industry hurdles. The platform also provides a GM stock prediction for the future. This study helps investors comprehend both the short-term risks and the possible long-term development of General Motors shares.

Factors Influencing GM Stock Price

Confused about Fintechzoom’s stock returns? Let’s see what our stock analysis says about GM’s market:

Electric Vehicle (EV) Expansion

GM’s huge investments in electric vehicles are an important factor influencing its stock price. The company has promised to manufacture a full range of EVs by 2035, competing with industry leaders such as Tesla. GM’s ability to grab market share in the EV sector is important to the stock’s growth as customer demand for EVs continues to climb.

Autonomous Driving Technology

GM’s collaboration with Cruise for self-driving technologies has drawn attention to the stock. If successfully marketed, autonomous driving has the potential to start new revenue streams, especially in ride-sharing and delivery services. However, regulatory approval and technical testing delays raise risks for investors anticipating near-term benefits in this area.

Supply Chain and Production Costs

Supply chain restrictions impact General Motors’ production capacities, which affects revenue and profit margins. Global interruptions have made it difficult to obtain important components, limiting the supply of popular models. Managing these expenditures is very important for GM to remain profitable without dramatically raising vehicle pricing.

Competition and Market Position

With new companies in both the traditional and electric vehicle industries, GM is under pressure to innovate while maintaining competitive pricing. Competitors like Ford and global companies like Volkswagen have produced strong EV vehicles, which forces GM to differentiate itself. GM’s huge dealer network remains unchanged, but staying relevant in a competitive industry is important to gaining investor confidence.

Government Policy and Incentives

Policies that encourage green technology and emission reductions show both risks and opportunities for GM. Government support for EV purchasers can promote sales, but pollution laws can raise compliance costs. GM’s participation in government initiatives for sustainable practices can improve its public image and attract more investors.

How Has Fintech Affected General Motors’ Operations?

Fintech has greatly impacted General Motors’ operations, particularly in areas like digital transformation and customer experience. Here is how:

Digital Payment and Financing Solutions

Fintech advancements have allowed GM to provide streamlined financing choices that improve the client experience and transaction efficiency. Digital payment solutions make the purchasing process easier for customers. This lowers the time required to arrange auto loans and boosts customer satisfaction.

Data Analysis and Predictive Maintenance

Fintech advancements in data analytics have allowed GM to perform predictive maintenance on vehicles. This helps identify potential mechanical defects before they become serious. Data analysis is important for improving vehicle durability and lowering warranty claims, directly benefiting GM’s profitability and brand reputation.

Automated and Efficient Supply Chain Management

GM simplifies supply chain management using fintech-driven automation and artificial intelligence. Blockchain technology has been proven effective for monitoring parts and validating supplier authenticity. This results in fewer delays and increased transparency between suppliers and customers.

What Is the Current Status of GM Stock?

As of March 28, 2025, General Motors (GM) stock is trading at $47.20, reflecting recent volatility due to news of a 25% tariff on imported vehicles and auto parts. Despite the dip, analysts maintain a “Buy” or “Overweight” rating, with a 12-month price target of around $61, suggesting potential upside.

Investors are drawn to GM’s focus on EVs and development into self-driving technologies. Fintechzoom GM stock forecast shows stability with small swings expected next year.

4 Investment Strategies for Fintechzoom GM Stock

Here are some of the best strategies we found for you to invest in GM stock:

Long-Term Growth Investments

A long-term investing approach suits those who believe GM’s future in EVs and autonomous driving is bright. This approach builds on GM’s multi-year transition to sustainable mobility, increasing EV production. Long-term investors benefit from GM’s commitment to EVs by surviving short-term market volatility.

Dividend Income Strategy

Income-focused investors value GM’s steady dividend payments. Holding GM shares in a dividend portfolio can provide a consistent income flow. GM’s financial soundness allows it to sustain or even boost dividends, making this technique appropriate for investors looking for a steady income.

Cyclical and Value Investing

GM is a cyclical stock that rises in response to favorable economic conditions and customer confidence. When the car sector experiences downturns, value investors can look for opportunities to buy GM shares at a discount. This is done in anticipation of a comeback once the economy rebounds.

ESG Investments

Investors prioritizing ESG factors can find GM’s commitment to carbon neutrality and sustainable innovation interesting. By incorporating sustainability into its business strategy, GM positions itself as a possible candidate for ESG-focused portfolios. This attracts investors looking to support environmental progress while benefiting from long-term development.

Risks of Investing in GM Stock

Investing in GM stock brings both opportunities and risks. Here are some of the main risks of investing in GM stock:

Intense Competition in the Car Industry

GM faces increased competition from automakers and electric vehicle (EV) businesses. Competitors like Tesla and Ford are investing in EV technology, which can influence General Motors’ market share and stock performance. If GM fails to keep up with advances, it risks losing investor trust and struggling to retain growth.

Economic Sensitivity

GM’s stock is susceptible to macroeconomic factors such as recessions and interest rate swings. Economic downturns can restrict customer spending on large-ticket items such as cars, affecting GM’s sales. As a fluctuating company, GM usually underperforms during economic downturns, so it is a riskier investment in uncertain financial times.

Supply Chain Disruptions

GM has been affected by global supply chain problems, particularly the semiconductor shortage. Long-term supply chain interruptions, especially for important car parts or raw materials for electric vehicle batteries, can cause manufacturing delays and sales losses. These delays can lead to lower revenues and higher stock price volatility.

Regulatory Risks

Government rules pose a risk to General Motors due to laws about emissions. Stricter pollution standards can raise production costs as General Motors invests in greener technologies. Failure to achieve these standards can result in fines or damage to GM’s public image, which could decrease stock performance.

Technological Risks and Innovation Challenges

GM’s success depends on its capacity to innovate in electric vehicles and autonomous driving. If GM fails to develop competitive technology or experiences delays in launching important parts, it risks losing its market advantage.

Furthermore, the enormous costs of R&D combined with the possibility of technical decay pose a serious threat to GM’s stock value. Failure to reach these innovative targets can damage investor trust and hide economic potential.

Buy and Sell With Fintechzoom GM Stock Analysis

Fintechzoom GM stock offers both opportunities and threats to investors. The company’s transition to electric vehicles and autonomous technologies creates growth opportunities. GM’s capacity to innovate while managing regulatory challenges will be important for its long-term success.

Before making a decision, investors should carefully consider all factors, including GM’s financial health and market positioning on Fintechzoom. Monitoring these risks can help investors make more confident decisions about GM shares.

FAQs

General Motors’s average recommendation is a Moderate Buy, according to experienced analysts.

As of March 28, 2025, GM continues to pay quarterly dividends. The last payment was $0.12 per share on March 20, and future payments are expected quarterly. GM recently raised the dividend to $0.15 per share starting with the next cycle.

Certain analysts believe that GM is worth its price due to the potential for future growth in the electric car business. However, some say it might be undervalued due to supply chain disruptions and competition.