Fintechzoom Ford Stock: Analyzing the Shift to EV

FintechZoom’s coverage of Ford stock is a way for you to become aware of the company’s financial performance and market trends. Ford is a long-standing car company that has responded to market developments with advances in electric vehicles and attempts at global growth.

Fintechzoom shows expert analysis and major industry events that impact Ford’s market position. You can get important information to learn about Fintechzoom Ford stock forecast 2025 and strategic initiatives. Now, it’s time to see how Fintechzoom Ford stock analysis can be your guide to buying or purchasing in the EV market.

What Is Meant by Fintechzoom Ford Stock?

Ford Motor Company is known for its rich car innovation and manufacturing history. It has long been a major player in the worldwide car market. Ford has many classic models, such as the Mustang and F-Series trucks, which have earned the company a loyal customer base and stock market prominence.

But what is the relation between Ford and Fintechzoom, you might ask? Fintechzoom is an important platform for investors that provides information and timely evaluations of Ford’s stock performance. It is well-known for its real-time data updates and technical analysis tools, which allow investors to make more informed decisions based on current market movements.

Current Performance of Ford Stock

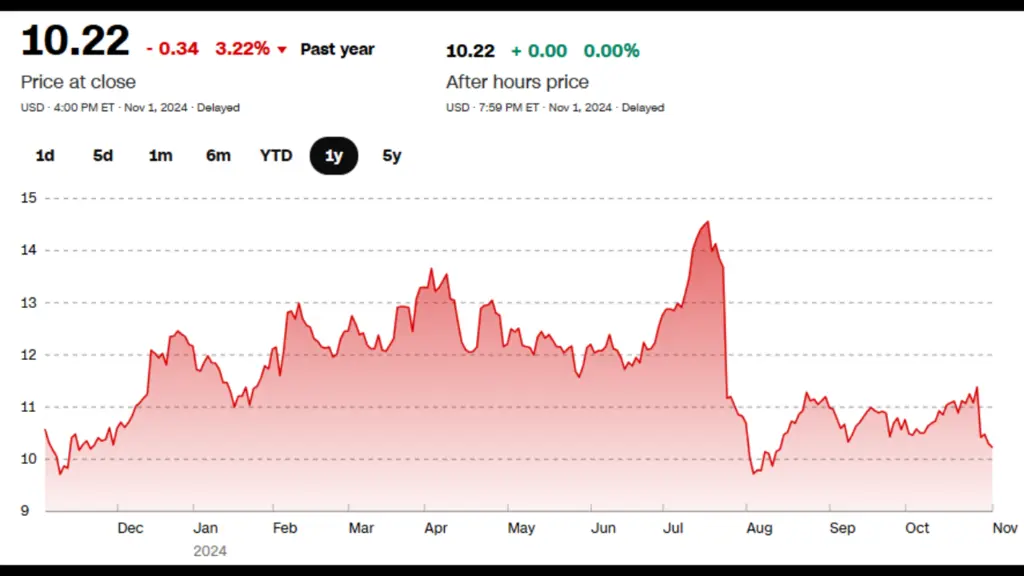

First, let’s have a look at the live Fintechzoom Ford Stock Price:

Ford’s stock has fluctuated widely, and as of 3rd November it has been trading at $10.22. This shows both risks and possibilities for investors who are interested in Ford. In recent months, factors such as increased production costs and inflation have influenced Ford’s share price, which has impacted the whole car market. Despite these obstacles, Ford’s investment in EVs has rearranged the brand.

This change intends to gain a part of the developing electric vehicle market where competitors like Tesla and Rivian stock are already operating. Investors have also reacted to Ford’s quarterly profits and revenue releases. Ford has also seen some operational difficulties, but the strong demand for EVs and breakthroughs in battery technology have helped sustain its share.

Fintechzoom’s Analysis and Tools for Ford Stock Investors

FintechZoom has several tools and analytical resources to help investors track and evaluate Ford stock. Here are some famous services provided by Fintechzoom:

- Real-Time Data Access: Gives live stock price updates for Ford so you can track price movements and trading volumes as they occur. This feature allows active investors to respond quickly to market developments.

- Technical Indicators: Configurable charting tools show moving averages and trade volumes. This information helps investors read Ford’s stock performance and find potential buying or selling opportunities based on historical patterns.

- News and Sentiment Tracking: Compiles industry news and social sentiment for Ford shares, which keeps investors updated on factors driving the automotive business. FintechZoom collects this data to help you understand current market events and long-term market patterns.

What Matters in Changing Ford Stock Value?

Like all prominent stocks, Ford also fluctuates based on some essential market factors, such as:

Financial Performance Metrics

Ford’s quarterly earnings reports and profit margins are all important indicators of its stock price. Experienced investors monitor this information to understand Ford’s financial stability and profitability. Positive financial performance promotes investor confidence, whereas decreasing earnings or revenue can lead to lower stock prices.

EV Market Transition

Ford’s investments in electric vehicles such as the Mustang Mach-E and F-150 Lightning are important for the stock’s long-term potential. Ford’s success in the EV market can benefit its stock as customer interest in sustainable mobility develops. However, issues in EV production or competition from businesses such as Tesla stock can damage Ford’s ability to profit from this market change.

Macroeconomic Factors

Macroeconomic factors such as interest rates and raw material costs directly impact Ford’s production expenses and profit margins. For example, high inflation can raise manufacturing costs, and increasing loan rates can lower consumer desire for new cars. Ford’s stock price fluctuates due to economic reasons and changes in company operations.

Customer Demand and Market Presumption

Customer demand for Ford’s classic cars and newer EV versions affects the company’s market position and stock price. Customer preference shifts occasionally, meaning greater interest in environmentally friendly vehicles can influence Ford’s sales and revenues.

Positive market sentiment and brand loyalty can help sustain Ford’s stock value. On the other hand, a decrease in demand or unfavorable public opinion can have the opposite impact.

Competitive Landscape

Ford competes in a fiercely competitive market with traditional giants like General Motors and Toyota. The company’s market share is influenced by its competitors’ performance, which pressures it to innovate. Ford’s ability to differentiate itself through unique models or complicated technologies is important for attracting more investors and keeping a competitive edge.

Comparative Analysis of Ford With Competitors

Ford competes with some big names in the car industry, and here is a comparison of how it stands against them:

| Factor | Ford | Tesla | Hyundai | Rivian |

| EV Market | Aims to merge its history with current technology but supply chain issues have put strains on its EV production. | Leading EV manufacturer with popular models such as the Model 3 and benefits from strong brand loyalty. It has a competitive advantage in production efficiency and battery technology. | Quickly gained ground in the EV market with models such as the Kona Electric. Known for its affordability and consistent production capabilities. | Newer EV manufacturer but despite its small production scale compared to Ford, Rivian’s unique positioning and innovation-focused strategy have gained attention. |

| Innovation and Technology | Focused on EV motors, hybrids, and its BlueCruise autonomous driving technology. However, in terms of software and battery technology, it is still catching up to more EV-focused competitors. | Sets the standard for electric vehicle technology with its complicated self-driving capabilities and integrated Supercharger network. | Investment in the E-GMP platform enables faster charging and better range. | Stands out for its adventure-focused technologies, such as off-road capability and adjustable driving modes. |

| Market Reach | Global footprint and established production network allow it to develop new models faster than upstart competitors such as Rivian. | Substantial production capacity at plants in the US, China, and Germany, which allows it to effectively satisfy worldwide demand. | Proven production capabilities in SK and global market reach make it a powerful rival. Its ability to manufacture EVs at reduced costs while retaining quality has helped it extend its EV footprint. | Limited production capacity presents issues in rising to meet demand. However, its focus on a specialized industry allows it to remain competitive in the United States. |

| Financial Performance | Stock performance shows a cautious investor attitude as it moves to electric vehicles. Investors view Ford’s EV journey as a work in progress with a focus on profitability despite the substantial expenses. | Highly valued stock due to consistent EV innovation and high gross margins. Tesla showed profitability and market domination in the electric vehicle sector. | Investors like Hyundai’s consistent growth, especially in the EV industry. | High-profile supporters and strategic focus on adventure-oriented EVs have sparked investor attention. However, Rivian’s small manufacturing and income make it a more speculative investment. |

Fintechzoom Ford Stock Prediction and Latest News

The future of Ford’s shares is tough as the company faces substantial challenges in its electric vehicle strategy. Ford recently reported a projected loss of $1 billion from its EV segment, leading to a 4% decline in stock value.

As the company releases new vehicles, Ford’s ability to scale manufacturing and satisfy increased consumer demand will be important. Analysts believe that if Ford efficiently manages its supply chain and production costs, it will boost investor confidence and improve its stock performance. Also, rivals like Tesla and Hyundai will give tough competition to Ford’s market share.

Summary: Fintechzoom Ford Stock Buy or Sell?

Buying Fintechzoom Ford stock depends entirely on your investment goals. But Ford’s dividend yield is 5.6%, which is a good option for investors seeking a steady payout. While Ford has a strong legacy and much revenue from traditional cars, its EV goals show possible financial challenges. Rest you can do your research from Fintechzoom as it shows the company’s strengths and risks.

Fintechzoom’s analysis and tools let you analyze Ford’s performance in a competitive market. For people interested in Fintechzoom ford stock forecast, tune into the website so you the make correct investment decisions as Ford tries to extend its electric vehicle footprint.

FAQs

Ford’s stock depends heavily on macroeconomic factors, even if the company is performing well. Growth in the auto business requires significant expenditures, limiting potential margin expansion.

Ford’s stock has been strong over the years, but it isn’t wise to expect Ford to reach $100 soon.

Ford’s stock value is relatively attractive due to the company’s strong cash profile and lower share price.