Fintechzoom Adobe Stock Strategies for Successful Investment

Adobe Inc. is a global digital media and software solutions leader known for transforming creative software. Fintechzoom is a prime resource for up-to-date information on Adobe’s stock performance.

You can learn market trends through in-depth analysis with the help of Fintechzoom. This article will tell you how Fintechzoom provides reliable data and expert opinions for all your investment needs.

What Is Adobe Inc.?

Adobe Inc. is an American multinational software company best known for developing software for digital media and digital marketing. It was founded in 1982 by John Warnock and Charles Geschke and first developed PostScript, a page description language essential in the desktop publishing revolution. Since then, Adobe has expanded into other fields and is currently located in San Jose, California.

Adobe’s Offerings & Products

Adobe has become a key leader in creative and enterprise software with ongoing digital media and content creation innovation. It has many amazing and regularly used products, such as:

- Creative Cloud: A subscription by Adobe that gives popular products such as Photoshop and After Effects. These applications are used by graphic designers, photographers, etc.

- Adobe Acrobat: It transformed the way people read and distribute documents. PDFs are a file type universally compatible with many devices and operating systems.

- Adobe Experience Cloud: It is a set of digital marketing and analytics tools that assist organizations in managing and analyzing their online presence.

Fintechzoom Adobe Stock Review

Adobe Inc.’s market capitalization ranks among the world’s largest software corporations. Adobe is well-known for its leadership in digital media and marketing technologies, and its stock has sparked investor interest due to its development trajectory.

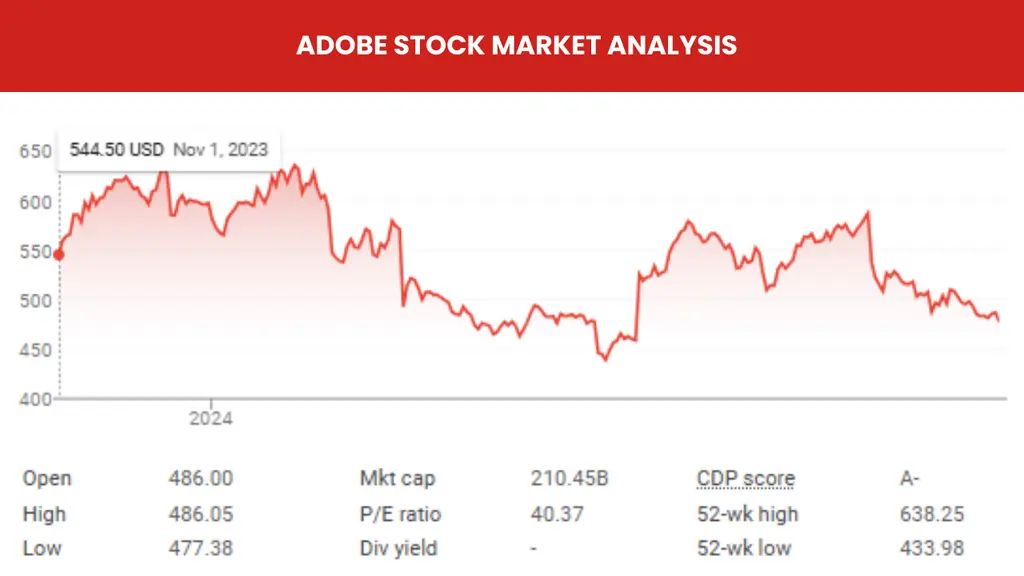

Market Capitalization and Stock Price

Adobe’s huge market capitalization shows its effect and sustained growth, and its stock price has risen significantly. This factor shows investor confidence in its consistent innovation and product demand. This valuation ranks it with other tech companies and shows its resilience and importance in the digital software market.

Growth and Financial Performance

Adobe has had sustained revenue growth due to the high demand for digital content development and marketing solutions. The company has produced exceptional earnings per share (EPS) in recent years while maintaining strong profit margins. Its performance has also been boosted by assets such as the recent purchase of the design platform Figma.

Factors That Influence Adobe Stock

Several things affect Adobe’s stock performance, such as industry trends and company-specific changes. Here’s a closer look at the major factors that can influence Adobe stock:

Product Innovation and Expansion

Adobe’s success heavily depends on its ability to innovate. It upgrades popular tools such as Photoshop and Illustrator while expanding into new markets. Introducing new features and software updates boosts investor confidence, as these can attract new clients while retaining existing ones. Expanding into areas such as AI-driven content production or cloud-based solutions can help Adobe capture industry trends, boosting stock values.

Subscription-based Revenue Model

Adobe’s transition to a subscription model particularly through Creative Cloud a stable revenue that lowers revenue volatility and boosts investor confidence in the company’s financial stability.

The success of this business is also dependent on customer retention and Adobe’s ability to offer appealing membership tiers and pricing methods.

Acquisitions and Strategic Partnerships

Adobe’s acquisitions, such as its recent purchase of Figma, have substantially impacted its worth, opening up new revenue streams and broadening the consumer base. Partnerships with firms in digital marketing and cloud computing are significant because they can expand Adobe’s market reach and competitiveness. This can positively affect Fintechzoom Adobe stock price and drive it up.

Economic Conditions and Market Trends

As a technology leader, Adobe is vulnerable to macroeconomic developments like inflation and interest rates, which can impact corporate budgets. However, Adobe’s business could benefit from technological trends such as the demand for digital content and remote work solutions. Businesses are increasingly relying on its software for content development and online services.

Competitive Environment

Adobe faces competition from Microsoft and Canva, particularly among small businesses and individual users. Adobe’s ability to sustain market share against these rivals is very important, as any loss of competitive edge can impact investor confidence, which can lower the stock price.

Financial Performance

Quarterly earnings announcements provide information on Adobe’s sales and predictions, which can trigger stock price movements based on actual performance. Investors follow key measures such as earnings per share (EPS) and cash flow. Positive surprises can increase the stock, while missed opportunities can lead to a drop.

5 Best Investment Strategies for Adobe Stock

Adobe Inc. is a great stock choice among tech investors due to its stable performance and strong subscription revenue. For people who are interested in investing in Adobe stock, there are numerous ways to explore depending on their financial goals and risk tolerance:

Long-Term Growth Investment

Adobe’s consistent revenue growth and expansion into emerging technologies make it an attractive long-term investment for growth-oriented investors. Long-term investors can benefit from Adobe’s capacity to develop and adapt, particularly as it transitions to AI and digital marketing solutions.

Holding Adobe stock for several years allows investors to experience market changes while capitalizing on the company’s growing market share. This method requires patience and an emphasis on Adobe’s long-term market potential rather than short-term price fluctuations.

Value Averaging or Dollar Cost Averaging (DCA)

The dollar-cost averaging strategy is suitable for investors looking to lower the impact of market volatility by spreading out their Adobe investments over time. Investors can invest a specified amount in Adobe stock regularly regardless of the current stock price.

This technique allows you to earn shares at various prices, lowering the average share cost over time. DCA can help reduce risk for investors hesitant to commit a big sum at once. It can also benefit those with a medium—to long-term outlook.

Growth and Momentum Trading

For investors with a higher risk tolerance, Adobe’s stock movement can give successful trading opportunities during earnings releases or product launches. Traders can capitalize on short-term stock price rises caused by positive earnings releases or important product revisions.

This technique is appropriate for experienced investors or traders with the time and expertise to closely monitor Adobe’s stock fluctuations. It requires quick answers to market fluctuations, which can be harmful for less active investors.

Investing with ETFs and Mutual Funds

Investing in technology-focused ETFs or mutual funds incorporating Adobe can be safer for those needing a safer strategy. This allows investors to profit from Adobe’s performance within a larger portfolio of technology equities. Adobe is popular in key tech and growth ETFs, including Nasdaq-100 index and S&P 500 funds.

This technique diversifies the investment and reduces the risk associated with each stock performance. However, Adobe is part of a bigger portfolio, so the potential profits from direct expansion are limited.

Speculative Short-Term Options Trading

Adobe’s stock can be a target for traders looking to profit from volatility during earnings announcements. Investors with a high-risk tolerance can speculate on Adobe’s price changes by using options methods such as call options or puts. Purchasing options rather than stocks allows you to profit from upward or downward price swings.

This is a high-risk technique that requires a thorough understanding of options trading. Speculative trading can result in big returns and substantial losses, so it is only appropriate for experienced traders.

How to Invest in Adobe Stock?

If you want to buy Adobe stock, you need an organized approach to make the process easier and more strategic. Here’s a step-by-step instruction on how to invest:

- First, find a reliable online brokerage that offers convenient access to Adobe stock. Check to see if the broker charges little or no commissions and consider any account minimums.

- Review its most current financial statements, including revenue and cash flow, to evaluate Adobe’s financial health.

- Consider how much money you are willing to invest in Adobe stock, considering your financial objectives and risk tolerance.

- If you prefer to hold in Adobe for years, a long-term buy-and-hold strategy can allow you to profit from the company’s growth over time.

- When you’re ready to buy, you can select between a market order, which buys the stock at its current price, and a limit order. After selecting your order type, confirm the transaction to purchase your Adobe shares.

Conclusion

Fintechzoom Adobe stock is a top choice for tech investors who want long-term gain. Adobe’s strong position in digital media and a dependable subscription model make it a popular choice among people interested in technology and innovation.

You can make more educated investing decisions by getting up to date on Adobe’s market trends and financial performance. To do this, Fintechzoom provides the most recent stock news and updates, so be sure to use it before investing.

FAQs

Adobe’s stock price is expected to rise soon, making it an excellent investment.

Shutterstock, Getty Images, iStock, Dreamstime, 123RF, Depositphotos, and Alamy are some of the main competitors.

The minimum withdrawal from Adobe Stock is $25. You must have this amount in your account before requesting a payout.