Ripple Price Fintechzoom | Expert Views on XRP Future Growth

Ripple is gaining much attention in the world of cryptocurrencies through price changes, which attract both traders and investors. The company’s success indicates a greater trend in the crypto market because it is based on a different concept from other digital payment firms.

To get the most important financial information regarding Ripple (XRP) stock, you can use Fintechzoom. Even experienced investors or people new to digital currencies can invest the right way with expert analysis from Fintechzoom.

What Is Ripple?

Ripple is a fast and low-cost digital payment technology that uses blockchain to facilitate international money transfers. Its cryptocurrency makes it highly sought after by financial institutions and cross-border payment solutions for network transactions.

Unlike other cryptocurrencies like Bitcoin, Ripple’s ultimate aim was always to build a consistent and cheap global payment system. Its unique structure and usage have elevated it into one of the most talked-about digital assets.

Fintechzoom and Ripple

Fintechzoom is one of the most famous platforms for financial news and research. It provides very insightful knowledge regarding Ripple’s price movement and market shifts.

Fintechzoom combines updates with expert perspectives, making it a go-to site for people interested in Ripple’s performance and future.

Ripple’s Role in the Cryptocurrency Market

Ripple is particularly useful in the Bitcoin market because it aims to speed up cross-border payments among financial institutions. It is different from most other cryptocurrencies in that it allows fast and scalable global transfers.

Its collaboration with banks and payment companies shows its feasibility as a bridge currency. This sets it apart as a practical answer to real-world financial problems. Ripple’s customized approach gives it a great position in the blockchain integration of traditional finance.

Current Ripple Price Fintechzoom

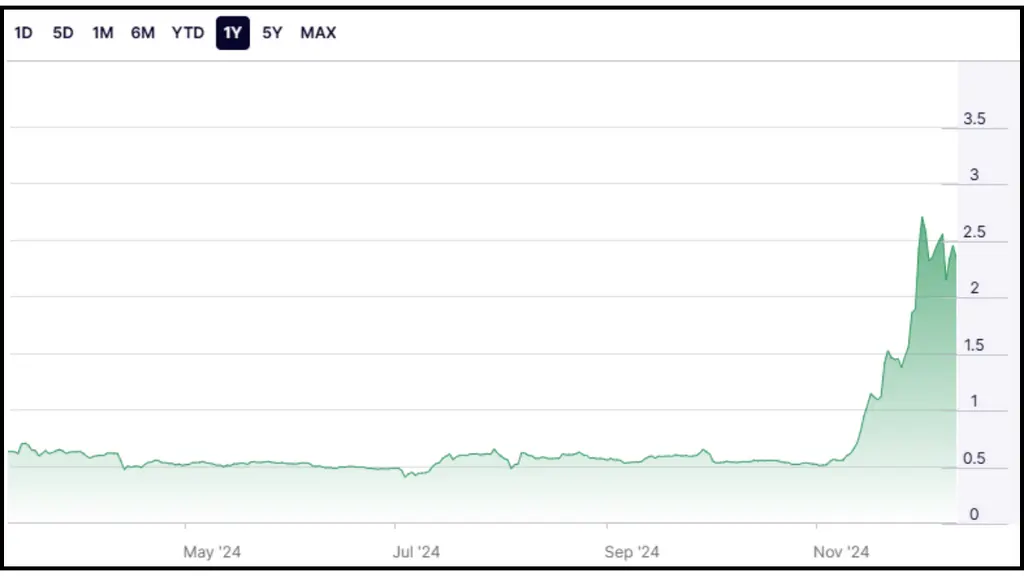

As of December 13, 2024, Ripple’s XRP is trading at around USD 2.41 with a 24-hour trading volume of around $10.35 billion. Over the last week, XRP has increased by 5.27% which shows increased investor interest.

How Does Ripple Work?

Here is the working of Ripple explained in detail:

Ripple’s Blockchain Technology

Ripple relies on RippleNet which is a decentralized blockchain network that allows faster and lower-cost transactions than traditional payment systems. Instead of proof-of-work or mining, Ripple uses a method in which many independent validators approve transactions. As a result, the system becomes more energy-efficient and scalable with the ability to handle large transaction volumes.

XRP as a Bridge Currency

XRP is a bridge currency that facilitates cross-border payments by allowing different currencies to be exchanged without the need for a central middleman. When two parties from different countries need to send money, XRP can be used to exchange currencies quickly and efficiently. This lowers correspondent bank requirements, lowering transfer costs and processing times.

Ripple’s Application in Financial Institutions

Ripple is primarily aimed at financial organizations as it gives a way to improve international payment networks. RippleNet allows banks and payment providers to speed up and reduce the cost of global transactions. XRP can deliver liquidity, allowing institutions to settle transactions more smoothly and quickly.

What Factors Influence Ripple Stock Price?

Some important factors that influence the price of Ripple stock are:

Market Sentiment and Investor Behavior

Ripple’s price is closely related to the overall sentiment in the cryptocurrency market. Positive news about adoption and market trends raises investor confidence which results in price hikes. Similarly, bearish trends or fear-driven selloffs can cause large price decreases.

Regulatory Developments

Government restrictions and legal issues have a big impact on Ripple’s value. For example, the SEC’s action against Ripple caused uncertainty, which lowered investor confidence and market stability. Favorable verdicts or regulatory clarity can boost Ripple’s price whereas negative outcomes could ruin investor confidence.

Technological Advancement and Adoption

Innovations in blockchain technology or network upgrades can influence Ripple’s market value. Price increases are associated with increased adoption by financial institutions using Ripple for cross-border payments. Similarly, development delays or the inability to fulfill market expectations can reduce its worth.

Partnerships and Ecosystem Growth

Ripple’s cooperation with banks and payment companies increases its real-world applicability. Each additional alliance boosts its legitimacy and can raise the price. However, a slowing of ecosystem expansion or the loss of alliances can impact its market performance.

Macroeconomic Factors

Macroeconomic factors like inflation, interest rates, and global financial stability influence ripple’s price. During periods of economic uncertainty, cryptocurrencies can gain popularity as alternative investments. However, tighter monetary policies or a strong US dollar can lower cryptocurrency prices, including those of Ripple.

How Does Fintechzoom Help You Stay Updated Ripple Price Trends?

Now that you have information on Ripple let’s learn how you can stay updated on Ripple Price Fintechzoom:

Real-time Market Updates

Fintechzoom provides its users with real-time data on Ripple’s price movements so they can track changes quickly. This real-time information is important for investors to make timely judgments in the unpredictable cryptocurrency market. Staying informed guarantees that you don’t miss out on important purchasing or selling opportunities.

Expert Analysis and Insights

The site includes a professional analysis of Ripple’s market performance which provides useful insights into price changes. These reviews help users understand the elements that influence Ripple’s value which ranges from market sentiment to regulatory news. New and experienced traders can make good investing decisions with this advice.

Comprehensive Historical Data

Fintechzoom crypto saves Ripple’s historical price movements, which gives a clear picture of its performance over time. This data helps users spot patterns, understand long-term potential, and plan investments. Understanding past trends will help you better predict future price fluctuations.

Ripple Price Fintechzoom Predictions

The future of Ripple can be evaluated through the following factors;

Adoption by Financial Institutions

If more banks and payment providers continue using the technology for cross-border transactions, the company is expected to become more prominent within the global financial system.

Ripple’s collaborations are set with major financial establishments that create a solid future growth base. Analysts predict that Ripple’s price will increase gradually during the coming years with increased usage.

Clear Regulatory End

The outcome of current legal challenges, particularly the legal action against the SEC, will impact Ripple’s future. A positive judgment will raise investor confidence and open up opportunities for more institutional investment. Regulatory certainty will also boost Ripple’s credibility and open up new markets and partnerships.

Technological Advancement and Network Expansion

Ripple’s focus on innovation in its blockchain technology would be key to its further success. Improvements in scalability and transaction speed open up the possibility of more users and businesses. As Ripple’s network grows with its blockchain integrated into global payment systems, so does its potential value.

Growing Demand for Cryptocurrency

The more familiar the world becomes with Bitcoin’s existence, the greater the demand for other digital-based currencies like Ripple.

Ripple’s ability to allow fast cross-border payments positions it well in a market increasingly looking for practical solutions. Ripple can benefit from this trend if the demand for global cryptocurrencies continues to rise.

Competition From Other Cryptocurrencies

Although Ripple has made some name in the cryptocurrency market, competition will still be important for its future progression. Any new cryptocurrencies with similar functions or even enhanced solutions can greatly influence their market share.

However, if it keeps progressing and strengthening its partnerships, it will continue to be people’s preference for financial purposes.

Where Can I Buy Ripple?

You can purchase Ripple (XRP) on several cryptocurrency exchanges. Here are some popular platforms for purchasing XRP:

- Binance: It is one of the leading cryptocurrency exchanges that provides XRP trading pairings with a lot of fiat currencies and other cryptocurrencies.

- Coinbase: It is a user-friendly platform, particularly for beginners that allows users to purchase XRP with fiat currency such as USD or EUR.

- Kraken: is a well-known exchange that provides XRP trading against many fiat currencies and cryptocurrencies.

- eToro: eToro is a social trading platform that allows you to get XRP and other digital assets directly as well as trade them.

- Gemini: It is a regulated exchange situated in the United States that allows you to trade XRP with numerous fiat currencies.

Note: Before making a purchase, check the platform’s prices and payment options. After purchasing XRP, always use a safe wallet to store it.

Conclusion

Ripple price Fintechzoom plays an important role in the cryptocurrency and banking industries. Ripple’s market trends are driven by adoption and technology breakthroughs, so investors need to stay current on its price.

Platforms like Fintechzoom provide insights into Ripple price changes, enabling better investing decisions. They are a must-have tool for anybody trying to understand and navigate Ripple’s market landscape.

FAQs

While XRP is far from dead, its future is unknown. The long-running legal dispute with the US Securities and Exchange Commission (SEC) is to blame.

The ending of legal challenges, political support, and institutional adoption are all factors that can drive its price to $100 by 2025.

A single unit of XRP is extremely cheap and many investors include XRP in their portfolios due to the large number of coins (estimated 45 billion) in circulation.