KITT Stock Fintechzoom Invest or Not in 2025?

KITT Stock has gained popularity due to the company focusing on autonomous underwater vehicles and new technologies for different industries. KITT Stock trades on the NASDAQ under the ticker “KITT,” and it is a unique investment opportunity with the potential for long-term growth.

Fintechzoom is important in raising awareness to stay updated on KITT stock. Let’s review this stock’s performance, risks, and prospects for KITT stock Fintechzoom.

What Is KITT Stock?

KITT stock is the name for Nauticus Robotics, a company that redefined the underwater robotics industry. This company focuses on creating different autonomous and AI-sight robots that can be used to perform a lot of underwater activities.

KITT represents an investment opportunity in the growing demand for modern underwater technology. The company’s robots can inspect and maintain equipment while reducing the need for human presence in hazardous underwater conditions.

Nauticus Robotics wants to increase the safety and sustainability of offshore operations. The investment opportunity represented by KITT is within an industry known for massive expansion in the immediate future.

KITT Stock Live Updates

KITT Stock Fintechzoom Performance

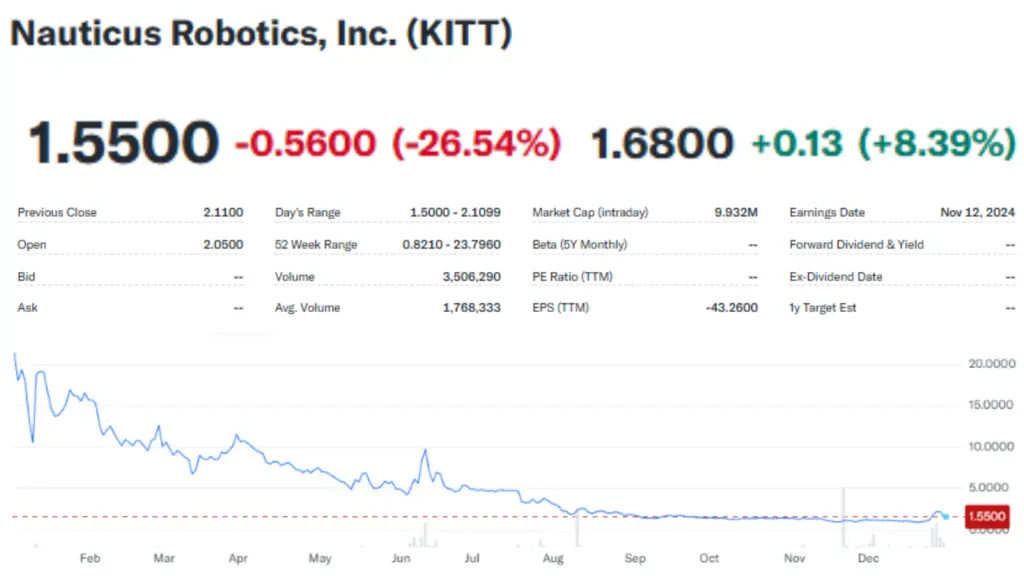

Over 2024, KITT’s stock has been extremely volatile, with a 52-week price change of -93.65%. In the third quarter of 2024, the company reported revenue above analysts’ forecasts while earnings per share (EPS) fell short.

Analyst reaction has changed, with some downgrading of the stock to ‘neutral’ and lowering price targets. Investors should be aware that KITT has a beta of -0.02, which shows lower price volatility than the market. While the company has big contracts and partnerships, its financials reflect a net loss of $55.86 million over the past year.

Recent Developments in KITT Stock Fintechzoom

Nauticus Robotics Inc. has recently taken big initiatives:

Debt Conversion Agreement

On November 5, 2024, Nauticus announced an agreement with existing debtholders to convert $33 million of debt into equity through a preferred stock exchange. This strategic move aims to reduce the company’s balance sheet leverage and address previously reported NASDAQ compliance issues.

Third Quarter 2024 Financial Results

The company reported its third-quarter financial results on November 12, 2024. Though the actual figures were not disclosed in the reports available, the earnings call transcript gives a clear view of the company’s performance and strategy.

Qualification and Commercial Operations Aquanaut Mark 2

In September 2024, Nauticus completed qualification testing of its Aquanaut Mark 2 underwater vehicle and began commercial operations in the Gulf of Mexico. The vehicle is now qualified for flyover surveys, leak detection, and visual inspections. It operates at a depth of around 1,000 meters.

Strategic Partnership with SeaTrepid International

In November 2024, Nauticus partnered with SeaTrepid International to integrate ToolKITT software in remotely operated vehicles (ROVs). This synergy is designed to give ROVs better capabilities for subsea operations.

Why Use Fintechzoom for Evaluating KITT Stock?

Using Fintechzoom to evaluate KITT stock can help investors make good investing decisions due to:

Reputable Financial Insights

Fintechzoom provides reliable and accurate financial data. It ensures investors receive up-to-date and trustworthy information. This platform covers various stocks such as KITT, with detailed performance analysis to help users understand short-term and long-term trends.

Comprehensive Coverage

Fintechzoom does provide basic stock prices and detailed coverage of companies, including KITT. This includes news on product developments, strategic partnerships, earnings reports, and market conditions, all of which can affect stock prices. Access to such detailed information allows investors to evaluate the broader context in which KITT operates, making it easier to anticipate future movements and trends.

Market and Investment News

Fintechzoom is one of the sites where investors will get current information about financial markets. By following Fintechzoom, you can always get timely updates about big happenings that can influence KITT Stock, such as launching a new product.

Good time information could mean the difference between a bad investment and one that works in your favor and one that is well timed.

User-Friendly Interface

The data given through Fintechzoom about financial things is so accessible and understandable for anyone. All this happened because the website’s interface simply explains complicated data, presenting easy-to-understand facts and information. Therefore, the interface also provides user-friendly support for amateur and expert investors to easily understand stock trends and patterns.

Expert Analysis and Tools

Fintechzoom’s strength lies in the expert analysis and investment tools it provides. The platform provides detailed reports and projections from industry professionals. These tools give you a more comprehensive understanding of KITT Stock’s potential. This way, you can make decisions based on comprehensive data rather than surface-level information.

What Lies Ahead for KITT Stock?

The future of KITT stock can be understood through the following factors:

- Analyst Price Targets: Analysts have set an average one-year price target of $2.55 for KITT, with estimates ranging from $2.52 to $2.62.

- Financial Forecasts: Revenue projections for 2025 vary, with estimates ranging from $52.7 million to $56.5 million. Earnings per share (EPS) predictions for 2025 are positive with estimates ranging from $0.03 to $0.03.

- Considerations: Analysts are projecting growth but the stock for KITT has been rather volatile. The trading range from the low to the high within the last 52 weeks is between $0.82 and $28.36.

Investors should pay close attention to their research and risk tolerance before making investment decisions.

6 Risks of Investing in KITT Stock

Investing in KITT Stock or Nauticus Robotics Inc. has some associated risks, which an investor should be aware of before investing. Some of the most important risks of KITT Stock are:

Volatility and Price Fluctuations

KITT Stock has shown a lot of volatility with its price going up and down much in the last year. The stock’s unpredictable price movement might not suit all investors, especially those with low-risk tolerance. The fluctuations could cause stress for those who prefer more stable investments.

Uncertain Financial Performance

Nauticus Robotics is yet to come close to becoming profitable consistently. The performance of KITT Stock relies highly on the company’s health regarding finances. Despite all strategic initiatives, it has seen a net loss of $55.86 million over the previous year. It is expected that finances can take considerable time to stabilize the company.

Dependence on Industry Conditions

Nauticus Robotics is a company that operates in the subsea robotics and AI industries. The company is highly prone to changes in technology and market demand.

If the demand for subsea robotics decreases or regulatory hurdles affect the industry, KITT Stock could be negatively impacted. External factors such as fluctuations in oil and gas prices or environmental policies may also affect the company’s performance.

Limited Track Record

As a relatively new player in robotics and AI, Nauticus Robotics has a very limited track record. While the company has managed to secure some strategic partnerships and develop cutting-edge technology, long-term success for the company remains uncertain.

This lack of a proven long-term business model increases the risk that investors face because the company might struggle with the scalability of its operations or achieving profitability on a sustainable basis.

Debt and Liquidity Issues

Nauticus Robotics has entered debt conversion agreements to address its balance sheet and reduce leverage. This would help alleviate short-term financial distress but reveal underlying liquidity concerns.

If it continues to suffer from cash flow or debt problems, it can affect the company’s ability to invest in R&D and other areas where it is severely needed. This will affect the value of KITT Stock.

Market Sentiment and Speculation

KITT Stock is sensitive to market sentiment and speculation. If investor interest weakens or there are negative news reports about the company, stock prices can drop rapidly. Emotional market responses and speculative trading can cause the price to change a lot. This makes it more difficult to know what to expect from the stock in the future.

Make the Right Buying Decision!

KITT Stock Fintechzoom provides investors the potential to participate in the subsea robotics business, but it also carries risks. Nauticus Robotics is developing amazing technologies and forming collaborations, but the company is still in its early stages and can face future obstacles.

Before making a decision, investors should carefully consider the risks and potential rewards. Always stay current on the company’s progress using platforms such as Fintechzoom.

FAQs

Nauticus Robotics, Inc.’s one-year price objective is about $2.55. The projections vary from $2.52 to $2.62.

To purchase KITT Stock, you must have a brokerage account that allows access to the NASDAQ market. You can choose the right broker with the help of Fintechzoom.

To stay updated on KITT Stock’s performance, follow financial news platforms such as Fintechzoom.