HSI Fintechzoom | Top Investment Strategies

The Hang Seng Index measures the performance of the largest and most prominent companies listed on the Hong Kong Stock Exchange. FintechZoom’s HSI coverage contains real-time updates and projections to help investors in watching market developments.

The best part is that Fintechzoom’s automated tools provide investors a chance to do strategic planning while investing in the dynamic Asian economy. Want to know how you can ace the HSI Fintechzoom game? Read till end.

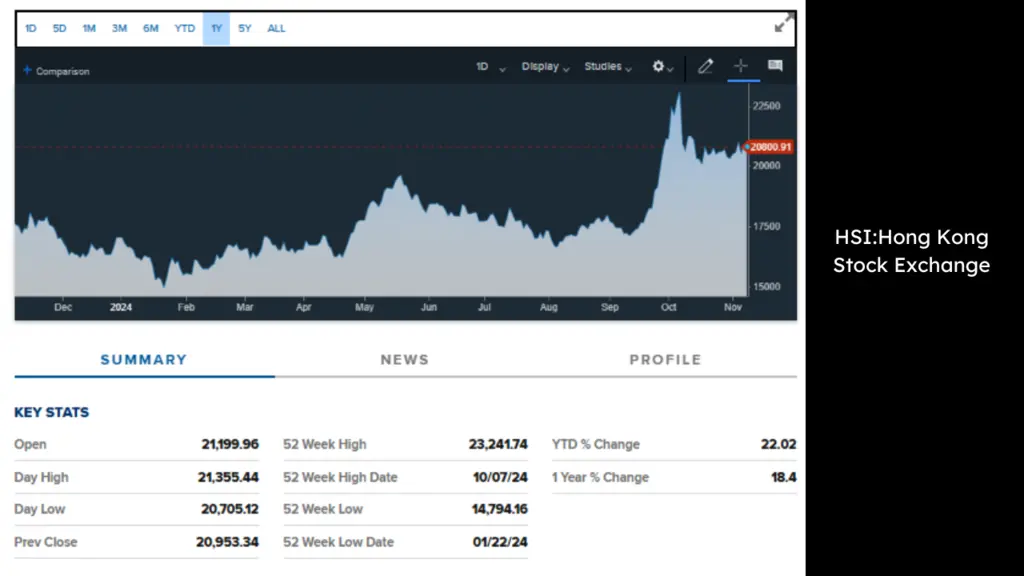

Live HSI Fintechzoom Index Price

What Is HSI Fintechzoom?

HSI FintechZoom is a platform that gives coverage of the Hang Seng Index (HSI). Hang Seng Bank launched the HSI in 1969 which initially had 33 companies and has increased to 50 constituents. Hang Seng Index accounts for approximately 58% of the total market capitalization on the Hong Kong Stock Exchange.

Fintechzoom’s coverage allows users to analyze HSI’s daily performance and access forecasts that help them make smart investment decisions. The overall market value of HSI firms is around HKD 11 trillion (USD 1.4 trillion). Companies like Alibaba and HSBC own a considerable percentage of this value.

What Companies and Sectors Are Represented in HSI?

The Hang Seng Index (HSI) shows prominent corporations in Hong Kong’s economy across multiple key sectors, such as:

Finance

The HSI has large financial organizations such as HSBC Holdings, AIA Group, and Hang Seng Bank. Finance is the backbone of Hong Kong’s economy with banking and asset management companies accounting for a big portion of the index’s weight.

Companies

Do you that Tencent Holdings and Alibaba Group are a part of HSI? Not just that, the technology industry stresses Hong Kong’s status as a hub for Chinese technology companies with worldwide reach. Companies in this sector have a considerable impact on HSI movements due to their high valuations and influence.

Real Estate

Sun Hung Kai Properties and Henderson Land Development are the top real estate firms on the HSI. Hong Kong’s property market is one of the most valuable in the world and the real estate industry has a big impact on index performance. It reflects the regional economic stability and market demand.

Utilities and Energy

The index has key utility and energy businesses such as CLP Holdings, Hong Kong and China Gas Company. These companies safeguard the region’s energy and utility stability while also giving information into infrastructure development and customer demand in Hong Kong.

Customer Goods and Retail

Key companies in the customer goods and retail industry are Budweiser Brewing Company APAC and WH Group. Customer products and retail companies are important because they show changing customer behaviors and trends in the Asian consumer market.

Healthcare

The main healthcare companies are Wuxi Biologics and Sino Biopharmaceutical. The healthcare industry is getting relevance within HSI as it shows the region’s trend toward healthcare innovation and pharmaceutical production.

Understanding What Affects HSI Performance

Many domestic and foreign factors influence the Hang Seng Index which in turn affects the performance of Hong Kong’s major corporations. For example:

Global Economic Indicators

The HSI is susceptible to global economic movements such as changes in interest rates by the US Federal Reserve and economic policies of major nations. Global trade trends and economic forecasts all play an important role. When global conditions improve, investor confidence in Asian markets rises which benefits the HSI.

Mainland China’s Economic Policy

Mainland China’s policies have a big impact on the HSI as many of the businesses listed in Hong Kong are Chinese multinationals. Government laws and key programs such as the Belt and Road Initiative can have a direct impact on the HSI sectors. This impact is especially true for finance and technology.

Hong Kong’s Political Climate

Local political stability is needed for investor trust in Hong Kong. Any changes in Hong Kong’s connection with mainland China changes in autonomy can cause volatility in the HSI. This is because investors perceive these events as potential threats to stability and economic growth.

Currency Exchange Rates

The strength of the Hong Kong dollar is connected to the US dollar influences the purchasing power and competitiveness of Hong Kong exports. Exchange rate swings can have an impact on foreign investor sentiment and company income. This is especially true for businesses with large international operations.

Sector-Specific Trends and Innovations

The HSI’s performance is also influenced by trends in its major areas such as technological advancements or changes in customer behavior. For example, increased e-commerce or new financial rules can promote specific HSI stocks. This will result in a better index performance.

Global Impact of HSI Trends

The Hang Seng Index’s trends have a big impact on global markets due to the connection of financial markets and Hong Kong’s importance as a gateway to China. HSI movements show economic trends and policy developments in mainland China.

When the HSI grows, it boosts confidence in other Asian markets and sparks worldwide interest in Asian assets. On the other hand, major declines in the index can cause caution on global stock exchanges.

Since many HSI companies are transnational, their performance can have an impact on investor mood around the world. Changes in HSI patterns have an impact on global tech equities since businesses like Tencent and Alibaba are actively monitored by international investors.

Investment Strategies for HSI Fintechzoom

Here are some useful strategies and thoughts for managing Fintechzoom investments in indices like HSI:

Protection Against Global Risks

Global economic factors have an impact on HSI’s performance, thus using safety measures can help protect against foreign market risks. Some investors use exchange-traded funds (ETFs) that track HSI to get exposure while controlling risk through diverse portfolios. This is important in periods of economic instability in Western markets.

Market Timing for Short-Term Gains

For skilled investors, short-term trading based on HSI’s daily volatility can be profitable. This strategy requires close monitoring of market events and policy changes especially in Mainland China. Short-term traders use technical analysis and market trends to profit from HSI’s intraday changes.

Long-Term Investment Strategy

Given the volatility of the HSI, many investors prefer a long-term strategy that capitalizes on Hong Kong’s ongoing economic growth. A long-term strategy helps investors to benefit from the index’s potential comeback after market issues while also profiting from Asia’s strong economy. Diversifying among HSI’s core industries can help to reduce risk while increasing the chance of possible returns.

Sector-Based Strategy

With HSI’s focus on finance and technology, sector-based strategies are popular among investors who want specific development opportunities. During periods of technological innovation in Asia, investing in companies such as Tencent or AIA Group would turn into huge gains.

Sector rotation techniques which involve shifting investments based on sector performance can help to improve returns as different sectors change.

Fintech Trends and What to Expect Next in HSI

As fintech continues to transform the financial sector, its impact on the Hang Seng Index (HSI) is more visible. Here’s what to expect from big meta trends in fintech that can influence the future HSI:

Digital Transformation of Financial Services

Hong Kong’s biggest financial institutions are investing in digital banking and automation. As these industries improve their digital capabilities, the HSI is likely to reflect this transition.

Financial sector development is closely linked to advancements in digital services and productivity gains from automation. Better customer experience and operational improvements in banking and insurance are likely to boost both market trust and profitability in the HSI.

Blockchain and Cryptocurrency Integration

The adoption of blockchain technology as well as anticipated regulatory backing for cryptocurrencies in Hong Kong could boost HSI global competitiveness. Major financial companies listed on the HSI are looking at blockchain applications for transaction efficiency and security.

Any supporting cryptocurrency policies could prompt additional investment in these areas. As investor interest in digital assets rises, blockchain advancements have an impact on the performance of key HSI companies.

More Cybersecurity Measures

With the rise of digital transactions, cybersecurity is an important focus for fintech. Companies in the HSI sector that lead in strong cybersecurity measures can attract investors looking for secure digital environments.

Customer trust and regulatory compliance is becoming more important for digital finance growth. This is why organizations that prioritize cybersecurity innovation are set to realize increased market resilience and higher HSI performance.

Invest With Confidence Through HSI Fintechzoom Reports

HSI Fintechzoom gives latest information and tools for understanding the Hang Seng Index—a stock market index that measures the performance Hong Kong’s main companies. Fintechzoom’s analysis and expert opinions keep investors alerted on trends in finance and other major industries that define the HSI.

So follow HSI on Fintechzoom to make better investment decisions whether you are looking for short-term opportunities or planning for long-term growth. Fintechzoom’s HSI coverage is important for anyone interested in fast paced and globally connected Asian markets.

FAQs

What Is the Meaning of Hang Seng?

Hang Seng is an index of share prices calculated using an average of 33 Hong Kong Stock Exchange equities.

Can I Invest in Hang Seng Index?

Yes, you can trade or invest in Hang Seng-listed stocks. You can also get exposure to the HS50 index which tracks Hang Seng.

Where Is Hang Seng Located?

The Hang Seng index is based in Hong Kong because it is a special administrative territory of China.