Fintechzoom PLTR Stock: Is AI-Powered Growth Sustainable?

Palantir Technologies is a data analytics company known for its powerful software for analyzing large amounts of data businesses and governments use. Palantir has received notice for its work in the corporate and governmental sectors, which helps companies make data-driven decisions.

With Fintechzoom’s financial news platform, you get the latest information on PLTR stock, such as price fluctuations and market trends. But is Fintechzoom PLTR stock a buy or sell? Find out the current market scenario and future stock changes through this detailed guide.

Palantir Technologies Coverage by Fintechzoom

Palantir Technologies is a famous name in the data analytics market. It focuses on the development of software systems and helps businesses build a strong system for data management and interpretation. Palantir was founded in 2003 and is headquartered in Denver, Colorado. The company rose to fame by collaborating with government agencies such as the United States Department of Defense and intelligence services.

Now that you know about Palantir, let’s learn about Fintechzoom. It is a well-known financial news and analysis platform that gives daily information and insights on PLTR stock.

FintechZoom is known for covering trending financial subjects as it takes an in-depth look at PLTR’s financials and partnership updates. With regular updates, FintechZoom keeps both new and experienced investors updated on Palantir’s market position and possible growth.

Live Fintechzoom PLTR Stock Price index

Palantir’s Core Business and Services

Palantir Technologies’ software platforms are designed to satisfy the requirements of private businesses and government organizations in different sectors. Here is some major information about Palantir’s business solutions:

Gotham

Palantir’s main platform for defense and intelligence operations was Gotham, which was first created for government clients. To find trends and help in real-time decision-making, Gotham allows users to collect, combine, and evaluate huge volumes of data. Gotham’s high-level analytical capabilities are shown by the apps it uses by government agencies for everything from tracking criminal activity.

Foundry

Foundry was created for business customers. It provides a simplified platform for managing and analyzing data. With Foundry, businesses can process complicated datasets from different sources, which can be useful for sectors like healthcare and finance.

Foundry is a powerful tool in any data-driven context. Healthcare institutions have used it to evaluate patient data and enhance decision-making processes.

Apollo

Gotham and Foundry are supported and updated by Palantir’s continuous delivery platform, Apollo. Apollo makes sure that Palantir’s platforms are always secure and up to date by automating software updates and deployments across many environments. It gives clients complex IT environments to install and maintain applications reliably and without interruption which makes it very important.

Financial Overview of PLTR Stock Since its IPO

Palantir Technologies stock, represented by the ticker symbol PLTR, has grown considerably since its initial public offering in September 2020. Here’s a look at its present financial situation and stock price movements.

Revenue Streams and Financial Health

Palantir’s revenues are mostly derived from government and commercial contracts. Government contracts give most of its revenue primarily through cooperation with US defense and intelligence organizations. Palantir has recently extended its business sector by offering deals in the banking and manufacturing industries.

Palantir announced much growth in client base and revenue in the third quarter of 2024 which showed a progressive transition toward a balanced income from both industries. The corporation has also used its Artificial Intelligence Platform (AIP) to boost sales, focusing strategically on AI for future revenue sources.

Key Financial Metrics

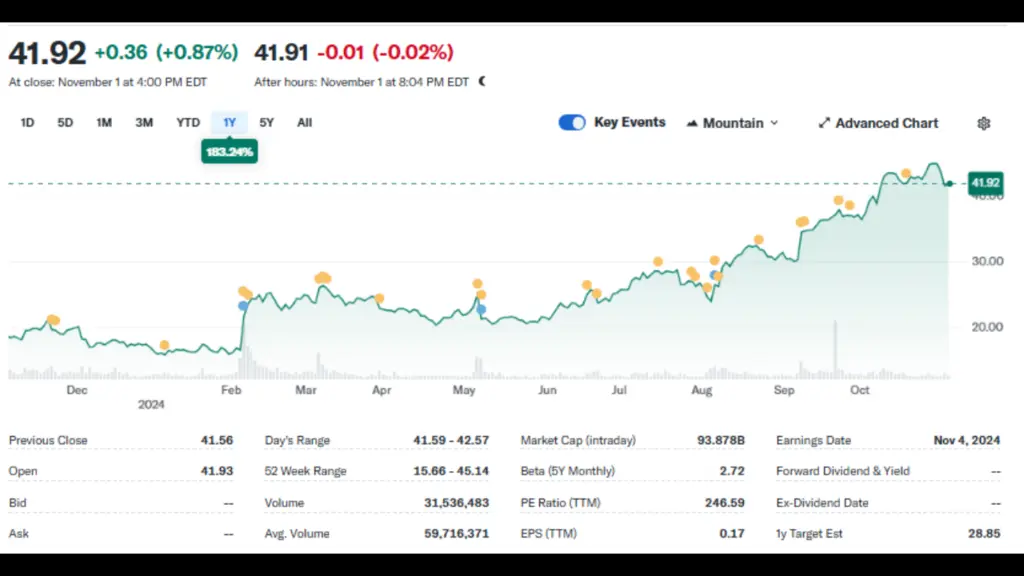

Palantir’s stock has a high Price-to-Earnings (P/E) ratio of around 246, showing a premium valuation in the technology sector. Analysts predict that profits per share (EPS) will increase by 36% in 2025, indicating that investor positiveness remains strong despite recent swings.

The company also values research and development (R&D) highly, which limits short-term profitability but can potentially increase its market position over time. Analysts continuously monitor Palantir’s free cash flow and operating margin, which shows the company’s dedication to rising effectively.

Stock Price History and Performance

Palantir’s stock price has fluctuated greatly since its initial public offering in 2020. The recent increase in share value was more than 150% by 2024, which showed investor confidence in the company’s AI capabilities. However, the stock price remains subject to tech industry trends and large announcements from high-profile collaborations. The stock is currently being traded at $41.92.

Fintechzoom’s Financial Analysis of the PLTR

FintechZoom allows investors to analyze trading patterns and learn about the possible risks and advantages of owning PLTR stock. The portal also provides information about Palantir’s revenue streams and future growth areas, such as the company’s strategic breakthroughs in AI and data analytics.

5 Risks and Challenges Investing in PLTR

After our current analysis of PLTR stock, here are certain risks that investors must be mindful of:

High Valuation and Volatility

The stock is currently trading at a relatively high valuation, but Palantir’s P/E is well over 200. This makes the stock susceptible to market movements and greater volatility, especially in tech. This is because the evaluation is observed through a swing along with changed trends or macroeconomic changes.

Analysts say that with great revenue growth, Palantir’s valuation could cap its upside if it fails to maintain strong expansion. This makes PLTR stock a high-risk investment option.

Profitability Issues

While Palantir showed revenue growth, the research and development expense has been very high in AI, damaging near-term profitability. Operating margins and net income for Palantir are adjusted to be profitable.

Still, these margins and income remain pretty low because of heavy R&D and operational expenditures. Investors will be waiting for years to see the company become profitable, which will destroy the stock’s performance.

AI and Data Analytics Competitor Landscape

This has raised stakes for data analytics and AI industries since other companies like Microsoft and Google will up their game through their AI and data product lines. Palantir would face competition dominated by giants with unlimited resources to command the market. Stunted growth in a customer base will fail if the stock doesn’t innovate or differentiate itself.

Limitations and Personal Risks

Government and intelligence agencies can raise regulatory and ethical problems for Palantir’s work with them, particularly regarding data privacy. Dealing with massive data and predictive analytics can expose the company to how data is used and protected.

More regulatory requirements or controversies surrounding data privacy could mean legal and reputational risks that could negatively impact investor confidence and the ability to expand into new markets.

Customer Concentration Risk

Palantir’s biggest clients are in the government sector. All its revenues are from major contracts, usually with US government agencies. The company could be greatly impacted by the loss or reduction of such an important contract or the government spending budget cut.

PLTR’s Future Growth Potential

Palantir Technologies could see significant growth in the future because of its focus on artificial intelligence and data analytics. Here’s what’s been going on:

AIP

The main reason is that Palantir’s Artificial Intelligence Platform (AIP) has gained special popularity in both the government and commercial sectors. AIP has a special panning effect in the defense domain, where real-time data processing and decision-making can be assured.

Defense AI

With defense-related AI applications and global military spending projected to grow, Palantir is well-positioned to gain from such applications. In the commercial sector, Palantir’s Foundry platform has seen expanding adoption across healthcare and finance. As more industries recognize the value of data-driven information, Foundry’s customer base is expected to grow.

Partnerships

Partnerships and client investments are other big indicators of Palantir’s future revenue growth. Analysts believe if Palantir continues innovating while scaling its applications based on AI, then the company will remain competitive in the AI and analytics space.

Conclusion

Considering all points, the coverage of Fintechzoom PLTR stock captures both growth and struggles. While Palantir’s AI and data platforms are uniquely positioned within governments and defense, commercial markets are slowly expanding.

PLTR does give some rays of hope to investors over AI and data, with due analysis of the market movement and financial sustainability. You can easily track all market movements of PLTR stock through Fintechzoom, so do your research before investing in it.

FAQs

It is stated that about 57.86% of the PLTR shares are owned by retail investors.

The stock is up more than 140% this year as the business is going in the S&P 500 and boosting its revenue growth.

In 2025, PLTR stock is predicted to hit $60.81, a 40% jump from 2024.