Fintechzoom MULN Stock | Recent Market Performance

MULN Stock has been a popular choice among investors who are trying their luck in electric vehicle (EV) businesses. The company is known for its creative EV designs and ambitious aims, so it has received much attention on sites like Fintechzoom.

MULN is popular because of its ability to change the car sector with environmentally friendly solutions. This article goes into the major characteristics of Mullen Automotive and tells you what makes it an appealing option for both EV fans and investors.

Live MULN Stock Updates

What Is MULN Stock?

MULN Stock refers to the publicly traded shares of Mullen Automotive Inc., an American EV company. It is listed on NASDAQ under the ticker symbol MULN and represents the company’s ambition to innovate in the EV space.

Mullen Automotive focuses on developing all-electric vehicles such as luxury sedans and SUVs, to pursue sustainable transportation options. Its stock has been in the spotlight due to its growth potential in the growing EV market.

MULN Stock offers a high-risk, high-reward opportunity to investors since the company is in its growth phase. Many key factors, such as market trends and developments in EV technology, will impact the value of the stock. You should keep track of the details from Fintechzoom for updates about MULN Stock.

Performance Overview of MULN Stock

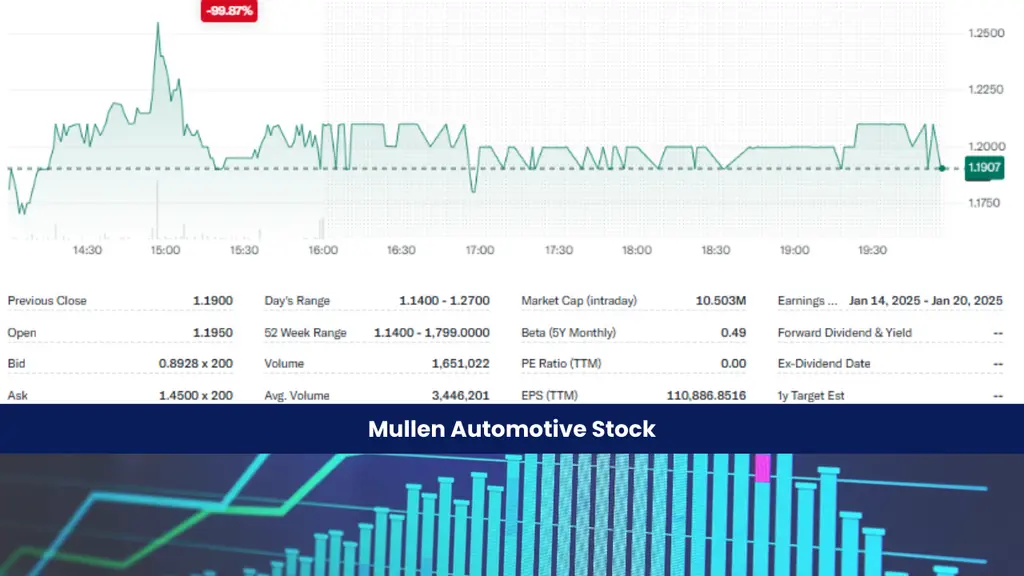

As of March 19, 2025, Mullen Automotive’s (NASDAQ: MULN) stock is trading at approximately $0.3923 per share. Over the past month, the stock has experienced significant fluctuations, reaching a high of $0.8200 and a low of $0.1880.

In the first quarter of fiscal year 2025, Mullen Automotive reported invoicing $4.4 million and receiving $6 million in cash for vehicles delivered, recognizing $2.9 million in revenues. This marks a notable improvement in the company’s financial performance compared to previous quarters.

Additionally, Mullen has successfully reduced its monthly cash burn rate from $16.8 million in August 2024 to $5.3 million in October and November 2024, reflecting improved operational efficiency.

These developments indicate positive momentum for Mullen Automotive as it continues to expand its presence in the electric vehicle market.

Despite these operational gains, the stock has fallen from a 52-week high of $1,799, which shows difficulty in the competitive electric vehicle sector.

Fintechzoom MULN Stock

Fintechzoom is an important source of information and updates on MULN Stock. It provides real-time stock performance statistics and market trends for Mullen Automotive. Fintechzoom provides investors with detailed breakdowns of MULN Stock movements including price fluctuations and major developments in the electric car sector.

The portal also features expert comments and forecasts which help customers evaluate prospective growth prospects and threats. Fintechzoom allows experienced and new investors to make informed decisions about their MULN Stock investments.

Mullen’s Position in the EV Market

Mullen’s current position in the electronic vehicles market is as follows:

Crowded Competition in the EV Market

Mullen Automotive competes in one of the most crowded EV industries dominated by well-funded players like Tesla and Rivian stock. The company is a relatively smaller player, but its success lies in focusing on places with specific market needs that large players tend to overlook. With this strategy, Mullen stands out but due to some challenges it still struggles to find loyal customers.

Differentiation through Advanced Battery Technology

Mullen is investing heavily in solid-state polymer battery technology which promises to revolutionize EV performance. These batteries are designed to provide longer driving ranges and improved safety compared to traditional lithium-ion batteries. If this is successful, it will give Mullen a competitive edge and put it at the front of innovation in the EV world.

Targeting Underserved Market Segments

Unlike many competitors, Mullen focuses on underserved market areas, such as affordable commercial EV fleets and compact electric cars for urban environments. These segments have high growth potential as businesses and people from urban areas find cheap and sustainable solutions. By addressing these specific needs, Mullen positions itself as a practical choice for these targeted audiences.

Strategic Partnerships and Collaborations

Mullen has strategically partnered with government agencies and private companies to strengthen its technological capabilities and market reach. Such partnerships allow Mullen to use the expertise and resources of others as an excellent starting point for sustainable growth. Furthermore, these partnerships enhance the company’s credibility and make it a good option for potential investors and customers in the future.

Growth Opportunities in a Growing Market

The global shift to sustainable transport is a big opportunity that Mullen can capitalize upon. Government incentives for adopting EVs, such as tax credits and subsidies, can increase customer interest in electric vehicles. Mullen is well-positioned to benefit from this increasingly growing demand with an emphasis on affordability and innovation.

Investor Opinion on MULN Stock

People who have invested in MULN stock have shared different perspectives, and some of them are:

Mixed Reactions Among Retail Investors

There has been huge retail investor interest in MULN Stock largely because of its low price and big potential to return the money. Most investors believe it is a speculative investment product with massive growth possibilities. Other considerations, such as the financial health of the company and its potential capability to increase production volume, call for concern among the investing community.

Institutional Investors Limited Involvement

The institutional investors have been the least involved in trading MULN Stock compared to retail investors. This is based on concerns over the stability of the company’s finances and lack of profitability which are important factors for institutional confidence. Despite this, some institutional players can track Mullen’s progress, but their involvement is low due to the risks.

Social Media Hype and Speculation

MULN Stock features on social media platforms such as Twitter and StockTwits. The retail investors on those sites are talking up its prospects. Some view Mullen’s positive stories related to its technological superiority and the following partnerships. Others question it with volatility and the stock’s financials as one such factor.

Doubts Regarding Financial Sustainability

Many investors are skeptical about Mullen’s potential to secure enough funding to implement its ambitious projects. A high cash burn rate with external financing has raised caution among investors. These and several other factors weigh into the investor sentiment when such a company is trying to balance innovation and stability.

Optimism Surrounding the EV Industry

Despite the setbacks, many investors are still optimistic due to the overall growth of the EV industry. Mullen focuses on affordable and innovative electric vehicles that fit the rising global demand for sustainable transportation. For high-risk investors, MULN Stock offers a chance to invest in a potentially transformative company.

Challenges Facing MULN Stock

Here are the current challenges faced by Mullen Automotive:

Financial Limits

Financial constraints heavily burden Mullen Automotive. Its operating costs are very high, and the revenue stream is unstable. The company’s reliance on external funding and capital weakens shareholder value and creates a long-term sustainability concern. Mullen Automotive has no steady revenue or profitability to invest in large-scale production and research.

Intense Competition in the EV Market

Huge EV giants such as Tesla and other car companies are transforming their manufacturing to EVs. Competing with dominant players with higher budgets and more brand awareness is quite difficult for Mullen. Competition by startups and other companies increases the challenge as Mullen has to secure its market share.

Production and Delivery Challenges

Scaling up production to satisfy demand is the other huge barrier for Mullen. Mass-producing electric vehicles need superior facilities and effective operations. In all these aspects, Mullen is still under development. Any delay in the production process or missed delivery targets will push investor sentiment down and ruin the trust of customers.

Investor Skepticism

MULN Stock has been a subject of skepticism from retail and institutional investors because of its highly volatile and speculative nature. Some investors are concerned about the company’s ability to execute its ambitious plans with minimal financial risks. Warnings of high risks and fluctuations in stock prices contribute to such uncertainty.

Technological Hurdles

Although Mullen aims to innovate in areas like solid-state batteries, achieving breakthroughs in EV technology is lengthy and costly. Competing technologies from larger companies surpass Mullen’s advancements and delays in product launches could undermine its credibility. Maintaining a technological edge in such a fast-evolving industry is an ongoing challenge.

Regulatory and Market Barriers

Operating in the EV market requires compliance with strict government regulations and safety standards. Mullen needs to follow these regulations as it expands into international markets, each with legal and logistical challenges. In addition, incentives or support for vehicles in different regions can be time-consuming and uncertain.

Final Verdict on MULN Stock!

Mullen Automotive’s MULN stock has both high risk and great profit potential. The company’s novel EV technology and market focus are promising but face many challenges. Investor opinion on Fintechzoom MULN stock varies. Mullen’s success is dependent on its ability to overcome the challenges it faces and it will have to show viability in the EV market. As of today, MULN is a speculative investment with unknown long-term potential.

FAQs

Mullen Group Ltd.’s consensus rating is Strong Buy based on 5 buy ratings, 1 hold rating, and 0 sell opinions.

The rapid decrease in Net Element’s performance this year shows the bigger market difficulties that have also affected MULN, resulting in its present low.

Yes, we believe Mullen has a solid financial platform for future growth in electric vehicle sales.