Fintechzoom.com Best Stocks to Buy Now Analysis

Finding the finest stocks to buy can be a good way to earn money, but you must make informed decisions. With so many options available, it is easy to become overwhelmed with market data and financial advice.

Fintechzoom.com best stocks to buy now simplifies the stock-picking process by focusing on high-performing stocks. So, it’s time to look at some of the greatest stocks Fintechzoom recommends buying right now.

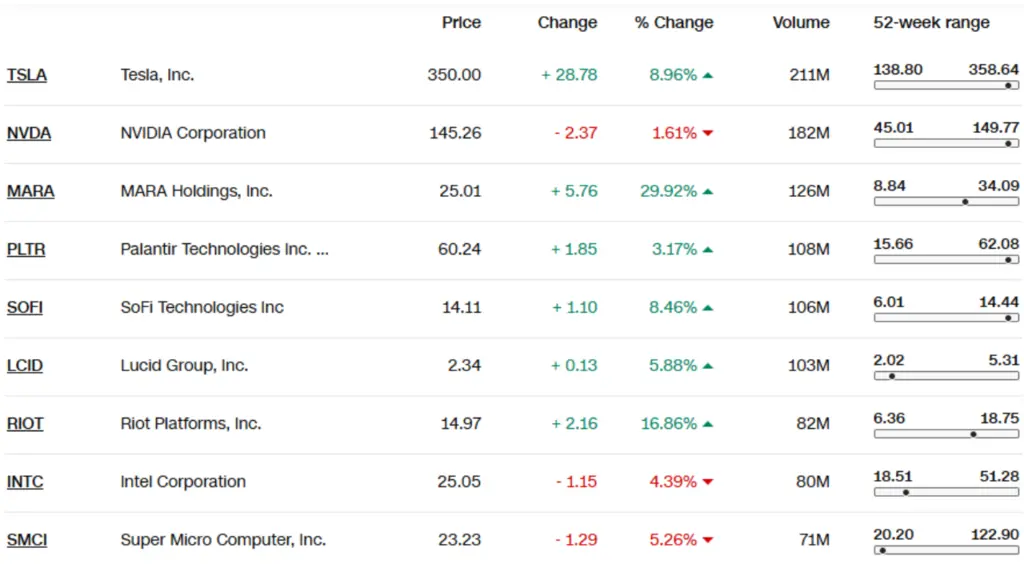

Fintechzoom.com Top Stock Gainers Today

Top Stock Gainers Today

Why Should You Use Fintechzoom to Monitor Stocks?

Fintechzoom is a great platform for reviewing your stock tracking choices because it provides information about market trading trends and financial news. Both new and experienced investors can use Fintechzoom to make better-informed and more strategic decisions.

What’s more? Let’s look at some amazing features of Fintechzoom.com best stocks to buy now analysis:

- Live Reporting: Provides real-time stock data. It allows users to track market fluctuations as they happen, which is very important for making timely investment decisions, especially during moments of market instability.

- Valuable Analysis: Shares information and expert opinions on stocks and market performances, covering different sectors and industries.

- Easy on the thumbs: Easy for users who are new to the site, and it presents data very clearly. Therefore it is easier and less time-consuming to track stocks.

- Covers everything: Details comprehensively about the fastest-growing tech stocks to steady dividend options. It covers all types of stocks that will help investors customize their portfolios according to individual goals.

Why Stock Selection Matters in Building Wealth?

Choosing the right stocks is an important step toward creating long-term wealth. The stocks you choose can significantly impact your financial future since they give different levels of growth potential and risk. Here are a few reasons why stock selection is very important:

Compounding Growth

Carefully chosen stocks can appreciate over time, allowing investors to profit from compounding gains. When you invest in high-quality, growth-oriented companies, your profits can compound, especially if dividends or gains are reinvested. This compounding effect is important to wealth accumulation over time.

Income Generation

Dividend-paying stocks provide a consistent income stream that can be reinvested to drive growth or withdrawn as passive income. Dividend stocks in sectors such as utilities and consumer goods are a popular option for many people who want to increase their wealth while receiving consistent distributions.

Risk Management

Not all stocks perform similarly in different market scenarios. Selecting a diversified portfolio of equities from multiple sectors helps to limit risk because economic shocks affect industries differently. A well-balanced growth portfolio and stable equities can protect investments against market volatility.

Meeting Financial Goals

The appropriate stocks will help you achieve your financial goals, whether you’re building money for retirement or generating passive income. Each stock has unique growth potential and risk, and choosing the proper ones will maintain your portfolio aligned with your personal goals.

Fintechzoom.com Best Stocks to Buy Now – Top Categories

Fintechzoom has a big list of stocks for you to choose from, and here are some types of stocks recommended by the platform:

Technology Stocks

Technology stocks have driven market growth over the last decade. Apple and Google continue to lead the way, which makes them a good portfolio of investments for long-term growth. Many of the companies have ongoing innovations and created markets that give them a competitive advantage over others.

Such companies make profits and have it reinvested in research and development to grow further. However, these stocks could be sensitive to economic conditions. Drops in customer spending or regulation changes would impact the value of these tech stocks overnight. Don’t forget that technology is an area that falls under the business sector and is one fundamental industry for any portfolio.

Healthcare Stocks

The healthcare sector’s demand has never decreased and has been reasonably maintained in the face of any economic downturn. Stocks like Johnson & Johnson and UnitedHealth Group are good choices for steady growth. As the population ages and biotech research is more invested, healthcare companies will rise in the long run.

Moreover, the invention of pharmaceutical and medical devices will provide new opportunities for revenue growth in the future. However, healthcare stocks are subject to regulatory review and changes in healthcare policy, which can pose risks to investors. However, healthcare is still a good choice for stable returns.

Renewable Energy Stocks

Renewable energy stocks have always been attractive in light of climate change and environmental sustainability. Companies such as NextEra Energy, Tesla, and Enphase Energy are leading companies revolutionizing the move to renewable energy solutions.

Investing in renewable energy allows you to support the environmental goals while positioning investors to benefit from a growing industry. Renewable energy companies tend to be expensive to set up, and the industry is also relatively vulnerable to changes in government policies. However, for those who want to ride on long-term growth, renewable energy is a good investment.

Financial Stocks

The financial sector includes the stocks of JPMorgan Chase and Bank of America, which are closely linked to a healthy economy. When the economy is sound, the performance of financial institutions is generally good, offering growth opportunities for investors.

Banks and other financial companies benefit from rising interest rates and good growth. Dividends from some of these shares add further value in the long term. However, financial stocks will depreciate during an economic recession or crisis, and changes in regulatory environments can influence the amount of profit they can generate. To sum it up, investing in financial stocks is a good option for those who believe that the economy will soon pick up and stabilize.

Industrial Stocks

The rise in construction and infrastructure spending will benefit industries, particularly companies such as Caterpillar and Honeywell. Governments of different countries also invest in infrastructure projects that support the demand for heavy machinery and construction services.

Industrial stocks can also grow well in an economic recovery phase. However, these stocks happen to be cyclical, as well as high and low at times. They can get more volatile, but for investors interested in growth associated with economic expansion, industrial stocks are a good option.

Dividend Stocks

Dividend-paying stocks like AT&T and Verizon pay regular income to their investors through dividend payments. Such stocks appeal to investors who often need regular income since they distribute their profits partly to their shareholders.

These stocks are less volatile, thus appealing to the risk-negative investor or those looking for regular income. However, some dividend stocks need a higher growth prospect than others. Although dividends provide stability, some specific companies must have a history of keeping or raising their payouts.

Cryptocurrency Stocks

If you are interested in digital finance, cryptocurrency-related stocks like Coinbase and PayPal are highly effective for entry into this market. The more people use digital assets and implement blockchain technology, the more these companies benefit.

Cryptocurrency stocks have high growth potential due to their early stage of blockchain technology. Their volatility and regulatory uncertainty make them slightly more suitable for risk-tolerant investors, and they provide a special opportunity for portfolio diversification.

Emerging Companies With High Stock Potential

Many emerging companies with great potential are expected to grow rapidly due to technological developments and environmental shifts. Renewable energy is a key sector, with businesses profiting from worldwide efforts to promote sustainability and reduce carbon emissions.

The electric vehicle (EV) business is also thriving due to advances in battery technology and growing interest in environmentally friendly transportation. Cybersecurity should also be noted due to the demand for digital protection that develops alongside our reliance on technology.

Biotechnology is also expanding due to advancements in medical treatments and individualized healthcare. All these industries have a lot of potential for future-oriented investors.

Conclusion

Fintechzoom.com best stocks to buy now are a list of stock options that you can buy right now and benefit from it in the future. Fintechzoom gives information on technology, dividend stocks, and many others so you can select stocks that meet your financial goals.

Fintechzoom provides a dependable resource for making informed investing decisions. Remember to thoroughly analyze each stock and evaluate how it fits into your overall investment strategy.

FAQs

The three best stocks to buy through Fintechzoom are Apple, Microsoft, and Johnson & Johnson. They are industry leaders with strong financial records that provide stability and long-term growth.

The Nasdaq, Dow Jones, S&P 500, and Composite are some popular stock indexes.

As a rule of thumb, 5% is a low margin, 10% is a reasonable margin, and 20% is a good profit margin.