Fintechzoom Boeing Stock | Updates and Investment Strategies

Boeing is the world’s largest aerospace company and holds great importance in the aviation and defense industries. Investors also pay close attention to Boeing stock because of its impact on the stock market and the broader economy.

If you’re a fellow investor, get into Fintechzoom Boeing stock insights to get a deep analysis of Boeing’s stock performance, trends, and market dynamics. This guide is here to explain what investors must know about Boeing stock’s value.

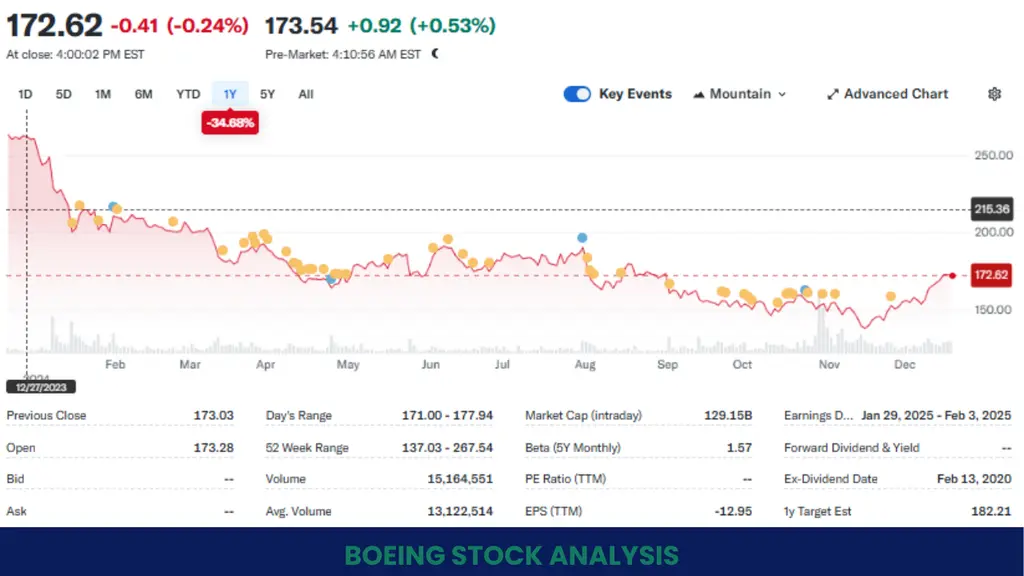

Live Boeing Stock Updates

Aviation Giant: Boeing’s Description

Boeing has a leading position in aircraft and space technology design. It was made in 1916 by William Boeing and today stands as a global power company headquartered in Arlington, Virginia. Boeing has a presence in more than 150 countries and provides commercial airplanes and even technology for space exploration.

The company has made iconic planes like the Boeing 747, which is the future of modern air travel. Its operations drive the aviation and defense industries. As the aerospace industry evolves, Boeing is innovating increasingly with a focus on sustainability.

What’s Going on With Boeing Stock Performance?

Boeing stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol ‘BA.’ It attracts much attention given the company’s worldwide influence and leadership in aerospace. Boeing’s long history of stock performance shows the resilience and challenges faced by the company.

Recently, Boeing’s shares have shown great volatility even though the impact of the COVID-19 pandemic on global air travel resulted in a sharp decline in the stock price. However, Boeing has since recovered and continues to thrive due to increasing demand for commercial aircraft and revived international travel.

Despite ongoing challenges like supply chain disruptions and economic uncertainties, Boeing’s stock is among the key indicators of the aerospace boom. Investors should focus more on the company’s general performance in the stock and market trends as part of long-term growth.

Has Boeing Stopped Paying Dividends?

As of March 28, 2025, Boeing has not reinstated its dividend payments since suspending them in March 2020 due to financial pressures exacerbated by the COVID-19 pandemic and operational challenges.

In recent years, Boeing has focused on strengthening its financial position by reducing debt and addressing production issues. Despite these efforts, the company has not announced specific plans or timelines for resuming dividend payments.

Investors should monitor Boeing’s financial performance and official communications for updates on dividend reinstatement.

Catch Up With Fintechzoom Boeing Stock Analysis

Fintechzoom is a reliable platform for financial analysis as it gives investors in-depth information on BA stock. Using advanced data analytics and real-time updates allows Fintechzoom to help investors stay ahead in a constantly changing market.

It breaks down complex financial information for easier understanding. For analyzing Boeing’s stock, the platform digs into quarterly earnings, industries, and external factors facing the company. These factors are supply chain disruptions or changes in geopolitics. Information like this helps investors find the reasons behind Boeing stock’s movements.

Fintechzoom also uses investors tools such as interactive charts and historical comparisons so investors can learn about trends and base decisions on data. By pointing out opportunities and risks associated with Boeing stock, Fintechzoom helps BA stock investors align strategies with the real market.

What Affects Boeing Stock Performance?

Just like any other stock, Fintechzoom BA stock is affected by certain factors like:

Commercial Aviation Trends

The requirement level for new aircraft is Boeing’s biggest indicator of good stock performance. While airlines were recovering from the pandemic by modernizing their fleets, Boeing enjoyed increased orders due to the popular model 737 MAX. However, market trends, including reduced traveling during economic downturns, can cause sales and investors to pull back.

Defence Contracts and Expenditures

The defense segment of Boeing generates stable revenue through government contracts for military aircraft and space systems. Geopolitical tensions and increasing global defense budgets boost demand for Boeing’s defense products. However, delays in government approvals or competition from rivals like Lockheed Martin can limit growth in this sector.

Supply Chain Challenges

Global supply chain disruptions have affected Boeing’s production and delivery schedule. Important parts shortages, such as in the engines and electronics industries, can delay manufacturing, revenue, and stock performance. Maintaining investor trust and market stability is important for Boeing’s management during these disruptions.

Economic Conditions

Macroeconomic factors like inflation and GDP growth influence Boeing’s business. During economic booms, airlines invest more in expanding fleets which boosts Boeing’s commercial aviation sales. Similarly, during recessions or high-interest rate environments, demand for new aircraft declines declines stock performance.

Regulatory and Safety Issues

Boeing stock is sensitive to regulatory oversight and has responded poorly after such events as the two 737 MAX crashes. Safety and regulatory compliance risks are fleet grounding and legal implications. Recovery through renewed safety and public communication will be very important in recovering its stock.

Technological Innovation

Innovations such as sustainable aviation and advanced manufacturing make Boeing less competitive and decrease the attractiveness of its stocks. New projects like carbon-neutral aircraft and partnerships in space exploration create profitable opportunities. The costs of research and development are high though they can put a strain on short-term profits which affects investor sentiment.

Geopolitical Tensions

Boeing operates in a highly globalized market which makes it vulnerable to geopolitical events like trade wars or international sanctions. Tensions between major economies can disrupt supply chains or limit access to key markets. For example, due to strained U.S. and China relations, Boeing isn’t able to tap into the full revenue potential of aircraft deals in the Asian market.

Airline Industry Recovery

As the airline industry slowly bounces back from the pandemic, Boeing is experiencing passenger and cargo orders growth. Due to borders opening slowly and international travel returning, there is an increase in demand for new fleets. However, unexpected setbacks such as new virus variants or travel restrictions can ruin this recovery and therefore impact the performances of one of the best stocks.

How to Invest in Boeing Stock?

Here are 6 of the best investment strategies you could use for investing in Boeing stock:

1) Long-Term Investment

Boeing is a good long-term investment for those who think the aerospace and defense sectors will thrive. Although Boeing has experienced several setbacks, its position as a commercial aviation and space exploration leader makes it a prime candidate for steady growth.

Through holding Boeing stock over the long term, investors will benefit from its recovery and expansion into emerging markets and new technologies.

2) Focus on Diversification

For risk-aware investors, Boeing stock can be of great value in adding diversification to a portfolio. Its exposure to several industries is diversified and does not create dependency on one source of revenue. Combined with investments in other industries like tech or healthcare, Boeing stock balances risks and rewards.

3) Track Industry Trends

Smart investors should closely monitor aviation and defense trends since they greatly impact Boeing’s stock. The rise in demand for air travel increases defense budgets and advancement in space technology is also a growth indicators. Timely decisions are made possible by keeping track of industry news through portals like Fintechzoom.

4) Short-term Trades to Consider

Active traders can take advantage of the volatility in Boeing’s stock due to earnings reports or geopolitical events. Short-term investors can use technical charts and price movements to find entry and exit points. This strategy is profitable but requires close attention to market trends and risk management.

5) Assess Dividend Potential

Although Boeing suspended its dividend payouts during the pandemic, investors should watch out for the resumption. Dividends can be a reliable source of income for growth-and-income-seeking investors. Announcement tracking of dividend resumption could indicate that Boeing is financially stable and thus attractive to income seekers.

6) Use FintechZoom Tools

Fintechzoom is a good source for giving valuable insight and tools to analyze Boeing’s stock performance. Their charts and market forecasts will help your investment decisions. With these in mind and some personal research, your investment will be stronger and more confident.

Fintechzoom Boeing Stock: Buy or Not?

Learning through Fintechzoom BA stock analysis is both an opportunity and a challenge for investors. The company is experiencing financial stress and has stopped its dividend payments. However, it is still one of the major players in the aerospace and defense sectors.

Boeing can look forward to good growth in the future with attempts to stabilize its finances and recovery in demand for aircraft. Staying updated with reliable sources will be the best approach to making informed decisions. As Boeing continues to find ways to face its challenges, its stock has the potential for recovery so it is worth it.

FAQs

You must make your first BA stock purchase through a broker. Your broker can then transfer the shares of stock to you and the stock will be held in your name.

Boeing used to be recognized as a conservative industrial powerhouse that built the safest and most advanced planes in the sky.

Boeing had a terrible third quarter and would most likely lose money this year, returning to profitability only in 2025. Analysts predict that Boeing’s earnings will reach $8.12 per share by 2027.